CIO View: Christian Nolting on the healthcare sector

Our Global CIO examines the demographic and technological changes transforming healthcare, and what they could mean for your portfolio

Rapid shifts in demographics and healthcare technology will create significant opportunities for healthcare investors in the coming years, but diversity and selectivity in this sector are still vital. These were the key messages delivered by Christian Nolting, our Global Chief Investment Officer, at the 2024 Global Innovation Summit.

Ageing populations will create undoubtedly create additional demand for healthcare services and new innovations to maintain quality of life, he said, noting that the term "longevity" has become a major search query in recent months. However, he added, there’s a disparity in health outcomes, with higher income groups enjoying better results. This disparity has social and political implications, which may lead to increased government spending on healthcare to address these issues and win elections.

Why technology is transforming healthcare but investors should be wary of buying into hype

Nolting emphasized the importance of substantial investment in research and development (R&D) to drive innovation and maintain growth in the healthcare sector.

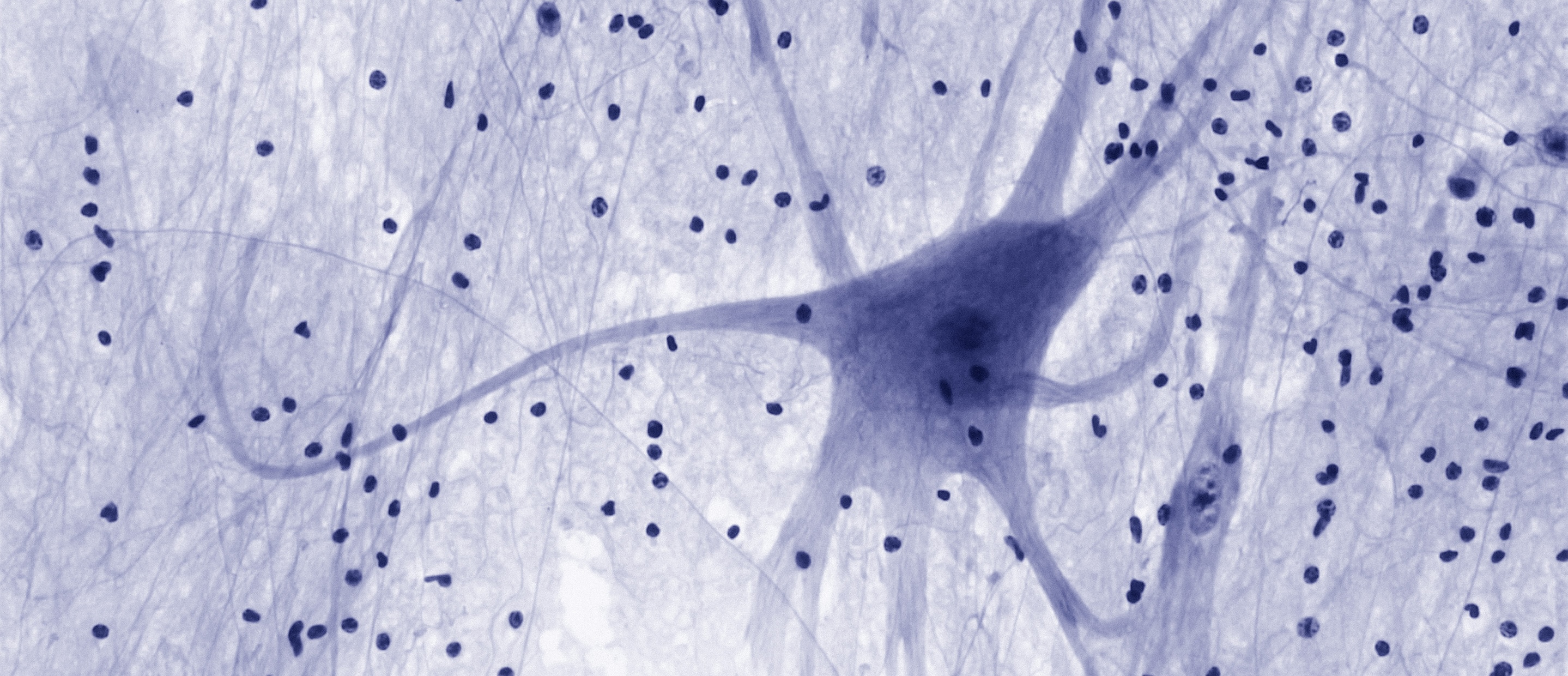

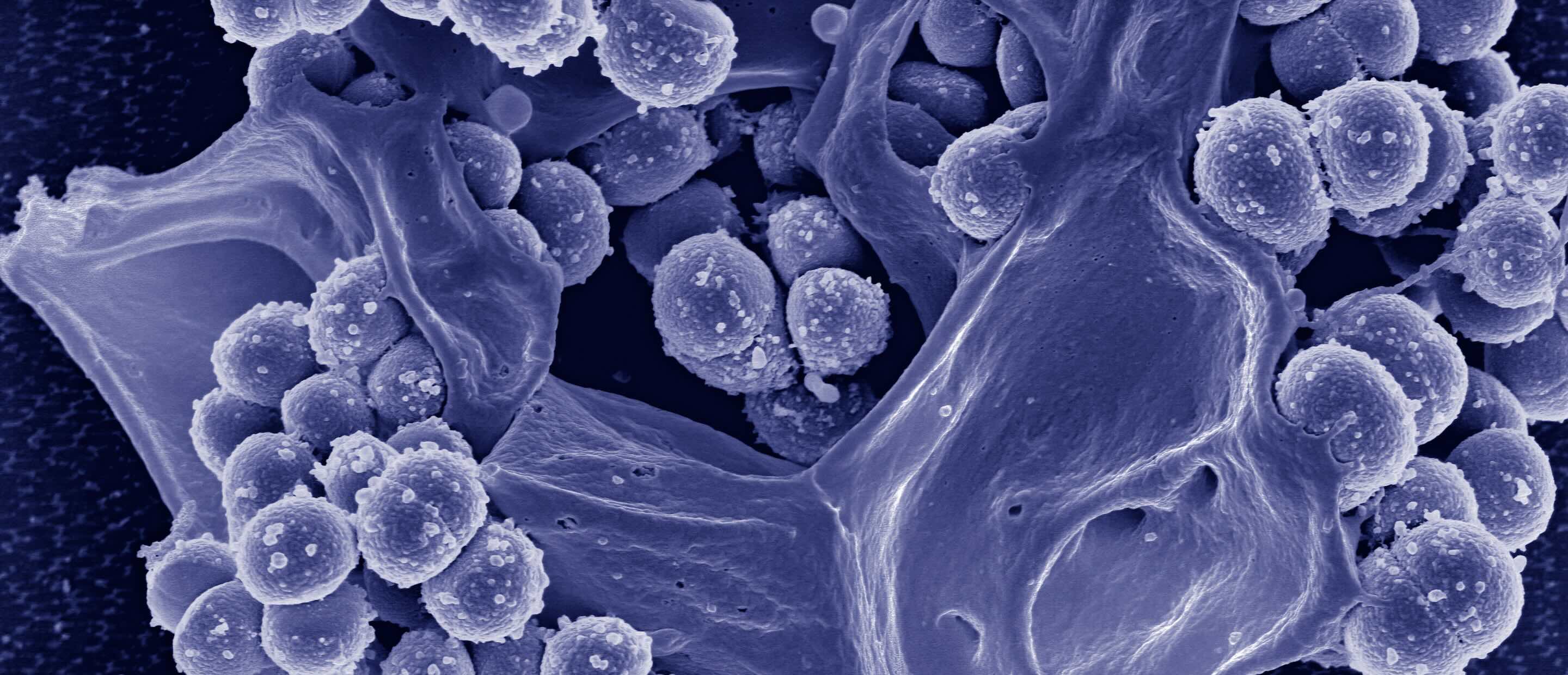

Certain technologies will have a transformative effect, especially artificial intelligence, which is already playing a significant role in the development of new pharmaceuticals and other medical products, leading to productivity gains and improved outcomes.

However, this is a sector with unique challenges: significant spending on research and development is required to create new products and political decisions, such as price caps on medications, can have a significant impact on profitability.

Traditionally, this is a sector that has been regarded by professional investors as a stable source of income, Nolting said, but it’s critical to be selective, focusing on areas with strong demand and political support over the long term.

Watch the full session or skip to the key takeways below:

Click here to activate this content.

Key takeaways from this session

- Demographic trends are expanding the sector, especially for certain diseases: Ageing populations are driving higher healthcare spending, particularly in high-income countries and emerging markets, with oncology and diabetes being key areas of focus.

- Income disparities impact healthcare outcomes: There is a significant correlation between income levels and life expectancy, with higher income groups enjoying better health outcomes. This disparity has social and political implications.

- Government expenditure on healthcare is rising: Governments are increasing their healthcare spending to address the needs of ageing populations and to win elections, as seen with initiatives such as Obamacare in the U.S.

- Technologies such as AI could transform healthcare: Artificial intelligence (AI) is already generating productivity gains and improved outcomes in certain areas such as pharmaceuticals development, but the risks of investors buying into hype are increasing in parallel, making selectivity even more important.

- R&D spending is crucial for healthcare innovation: The healthcare sector requires substantial investment in research and development (R&D) to drive innovation and maintain growth.

- Political influence affects healthcare profitability: Political decisions, such as price caps on medications, can impact the profitability of healthcare companies, making it essential to be consider long-term political trends when investing in the sector.

- Healthcare investments can aid portfolio stability: Healthcare is traditionally a stable and essential component of investment portfolios, offering diversification and resilience during market downturns, though – as ever – past performance cannot guarantee future returns.

- Selective investment in healthcare is key: Investors need to be selective within the healthcare sector, focusing on areas with strong demand and political support over the long term.