The Sustainable Blue Economy

A healthy ocean is central to our planet's future. At Deutsche Bank, we are committed to playing our part in building a sustainable blue economy.

The Ocean provides key ecosystem services crucial for the prosperity of the global economy, as well as benefitting human wellbeing and the generations to come.

Explore our articles, podcasts and special reports dedicated to ocean conservation and the development of a sustainable blue economy.

Expert views

Ocean entrepreneurs

Partners and champions

CIO report library

An ocean journey

We are on a journey to raise awareness about the importance of the ocean to the global economy and life on earth.

Why the term 'Sustainable Blue Economy' is important

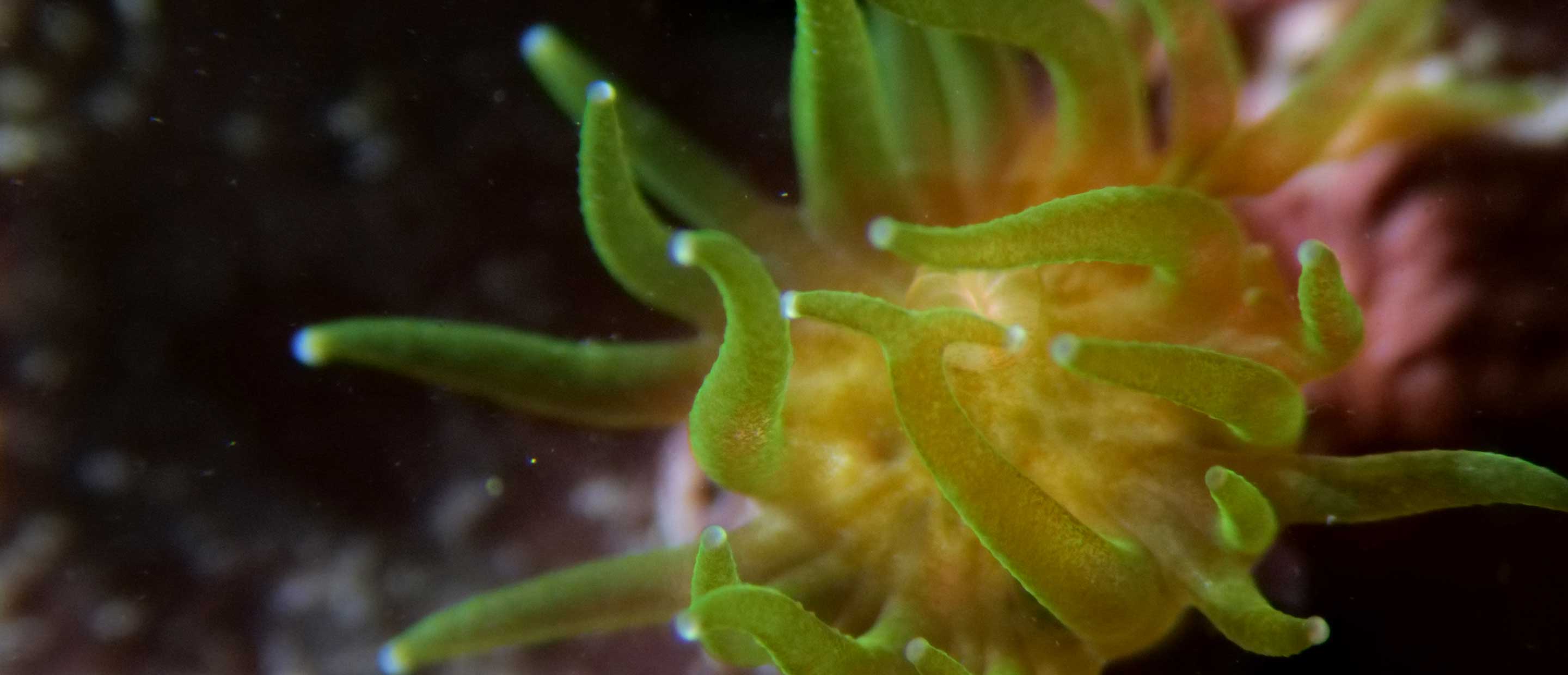

Coral in crisis: a reminder of what's at stake for our ocean

Events Highlights

The DB x ORRAA Ocean Conference 2022

Co-hosted by Deutsche Bank and the Ocean Risk and Resilience Action Alliance (ORRAA), the DB x ORRAA Ocean Conference aimed to to demystify the sustainable blue economy and show how private capital can help achieve positive ocean impact at scale.

Sep 16, 2022

CIO Nature Series

Corals: the rainforests of the sea

This introductory guide to the global threats facing coral reefs – and what we can do to reduce them – is part of our new CIO Nature Series providing insights on nature-based solutions to address climate impacts and foster adaptation efforts.

Jun 24, 2022

The sustainable blue economy

Kristen Marhaver: the coral whisperer

Marine biologist, TED and WEF star, Kristen Marhaver discusses how rapid scientific advance and philanthropic support are combining to make the idea of regrowing the world’s coral a real prospect.

Oct 13, 2020