057260 101325

Family Office Financing Report 2025

In an increasingly complex global environment, family offices are faced with multiple challenges – from geopolitical and economic uncertainty to rapid technological change.

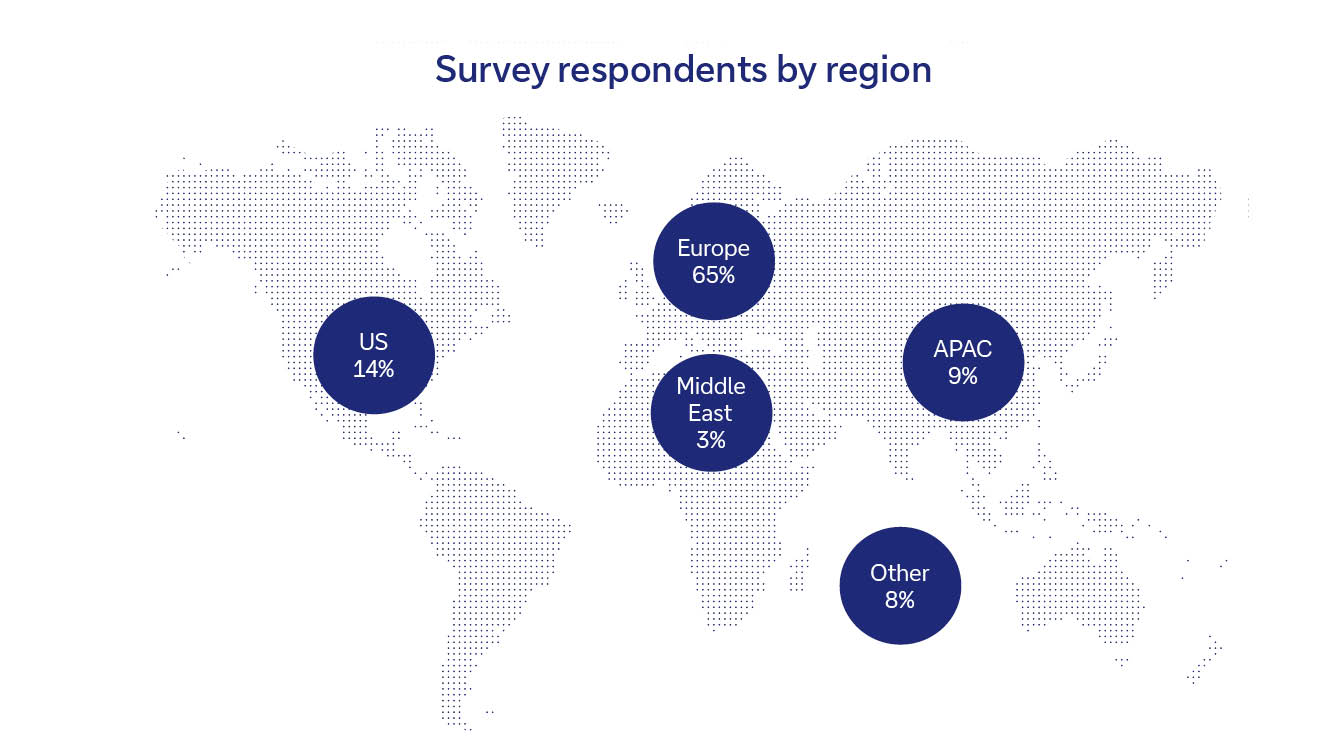

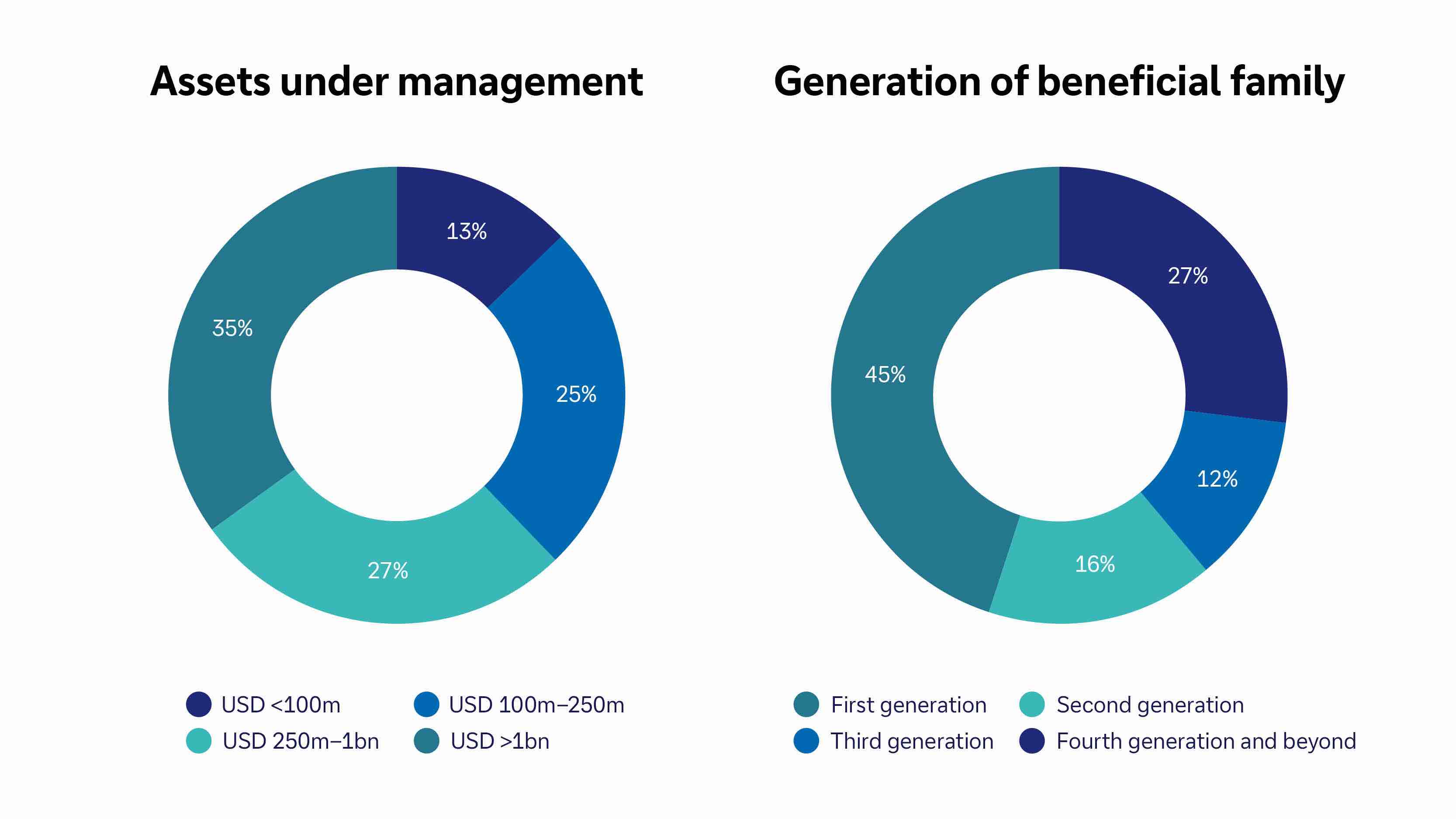

Our inaugural Family Office Financing Report examines how family offices are positioning themselves to seize opportunities and manage risk amidst an ever-changing backdrop. It is based on the insights of over 200 family offices globally, as well as in-depth interviews with clients and Deutsche Bank experts.

In an era defined by rapid transformation and persistent uncertainty, the world faces seismic shifts – from generational transitions and digital revolutions to climate urgency and evolving societal expectations. Against this backdrop, family offices have demonstrated a commitment to resilience.

Our findings signal that family offices are increasingly adopting a more institutional approach to investing. By setting up “war chests”, family offices are preparing themselves to rebalance and manage their leverage when certain asset prices fall. Illiquid assets form a core part of portfolios, and are being leveraged more often, while most family offices are also engaged in private credit and expect high returns.

We are hugely grateful to our survey respondents, who represent some of the largest and most established family offices in the world, and especially to our clients who agreed to be interviewed in depth for this report, adding an invaluable layer of qualitative analysis to our findings.

News and insights for family offices

Event report

Global economic outlook: the key risks and opportunities

Global growth prospects, the impact of US tariffs on inflation and expectations for bonds, equities and gold were on the agenda in this session featuring interactive audience polling.

Jul 24, 2025

Event report

London Family Office Forum 2025: Geopolitics and geoeconomics

India’s High Commissioner to the U.K. and the head of Chatham House shared timely insights as we discussed the latest disruptions to international norms.

Jul 18, 2025

Event report

London Family Office Forum 2025: Managing assets in the new world order

Europe’s rise as a geopolitical force and investment opportunity was a core theme as a record number of family officers joined us in London for this exciting event.

Jul 04, 2025

News feature

What is family governance and why does it matter in a family office?

Family governance centres on agreed processes for how a family office makes decisions, how changes are implemented, and the roles and responsibilities of individuals within the family and the business.

Jun 05, 2025

Event report

Emerging Markets Family Office Forum 2025: Securing Perpetuity and Impact in Asia

Against a backdrop of tariff turmoil and geopolitical uncertainty, Deutsche Bank Wealth Management's second annual Emerging Markets Family Office Forum offered a platform for dialogue, insight and cross-border connection.

Apr 14, 2025