This report delves into the transformative shifts in the power markets driven by increasing electricity consumption. As demand surges, primarily due to electrification and data centre expansion, the need for low-emission energy sources becomes critical. This transition necessitates significant investments in grid expansion and modernisation to integrate renewable energy sources while maintaining system stability and resilience.

The report highlights the financial implications, including higher capital expenditures and potential earnings growth for utilities. It also addresses the challenges posed by the macro environment, regulatory delays, and geopolitical events.

Despite recent years' underperformance, the long-term investment case for utilities remains strong. Growing electricity demand, the need for grid expansion, and financial incentives for renewable investments present significant opportunities. Utilities are well-positioned for earnings growth and returns, making them an attractive option for investors looking to capitalise on the energy transition.

Key takeaways:

- Increases in electricity consumption are reshaping power markets. Higher demand will need to be met by low-emission sources, but this will create challenges.

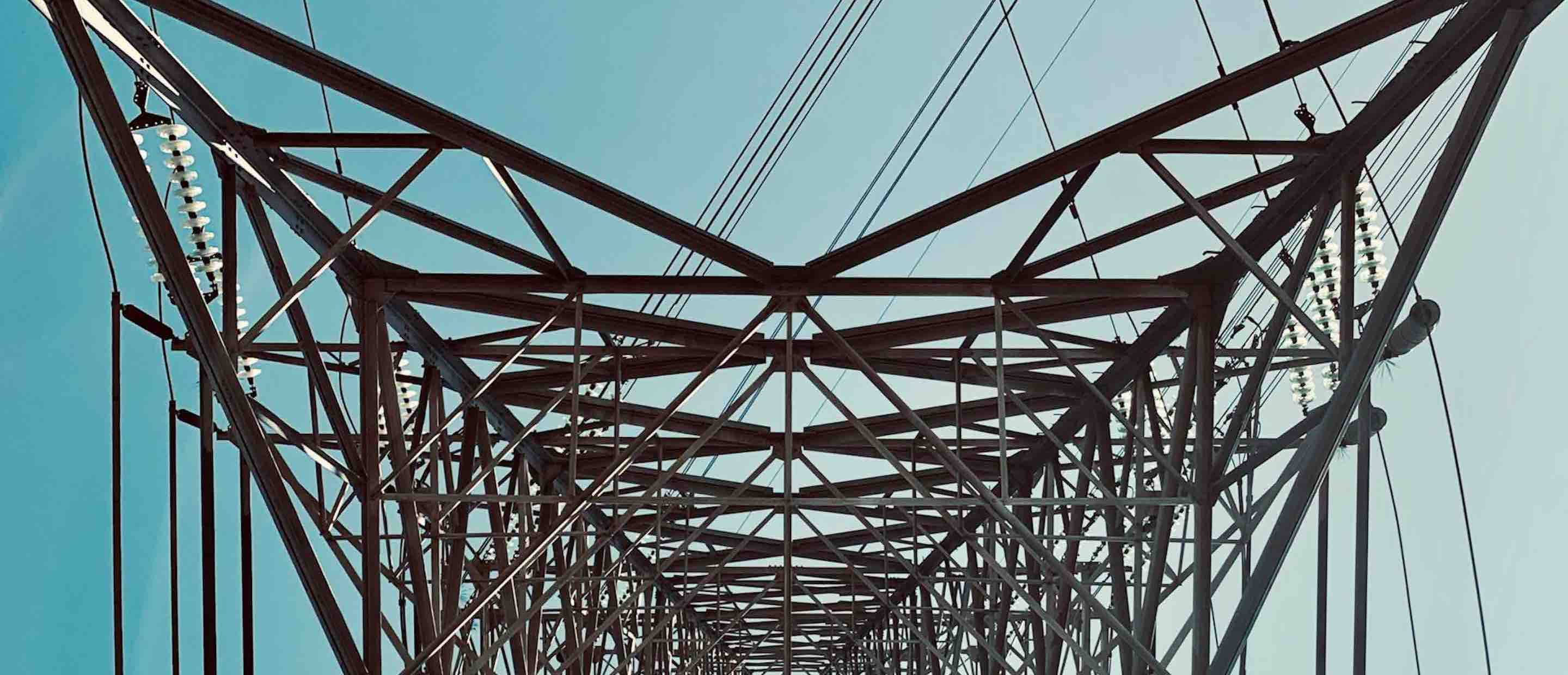

- Grids will need to be expanded to incorporate dispersed renewables generation, and modernized to enhance efficiency, reliability and security.

- This creates a long-term investment case for Utilities, with potential re-rating vs. the overall market. Higher capital expenditure is likely to translate into substantial earnings growth.