Our latest CIO Special looks at likely future trends in ESG assessment and why biodiversity will be an increasingly important consideration.

Topics covered include:

- Current ESG assessment issues and score sustainability.

- Corporates’ impact on ecosystems and the different types of nature-related risk.

- The “double-materiality” of nature loss and how we can measure its impact.

- The green paradox and making the leap to a sustainable growth path

To download the full report, please click here - Biodiversity: the new playing field for ESG assessment

Introduction

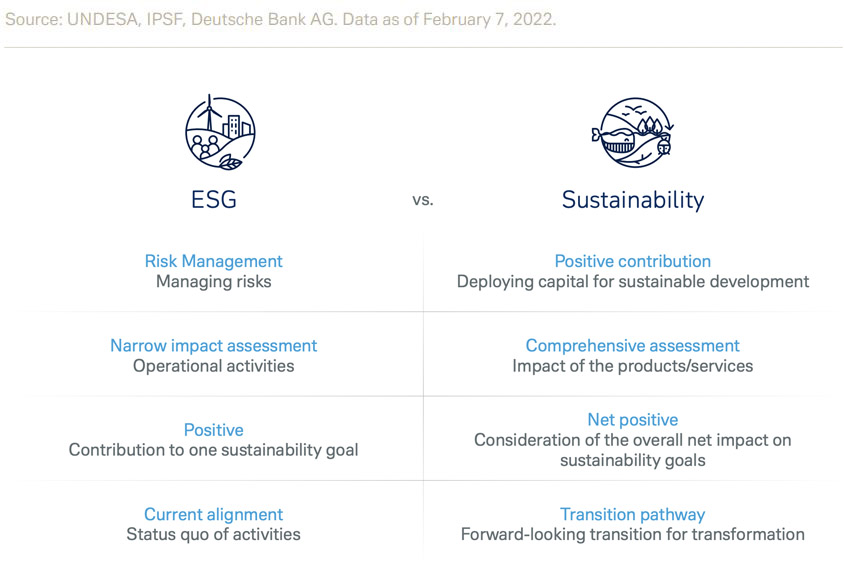

ESG is a term that has become increasingly established in the past few years. But what exactly is ESG investing? ESG investing is a conscious decision to take environmental, social and governance criteria into consideration in regards of investment decision-making. One can now say that ESG investing has become mainstream, accounting for more than 36% of total funds under management globally. However, while the concept of ESG spotlights three specific pillars to today’s business, the transition to fully sustainable business practices will require a yet-broader approach to ensure we can support the planet's health for generations to come as depicted in Figure 1.

Consideration of ESG criteria, however, creates challenges as well as potential rewards. Traditional investment theory assumes that prices in financial markets fully reveal all available information. However, growing information flows (especially when they create a situation of “asymmetric information”, i.e. one party knowing more than another) can prove unsettling, often leading to higher volatility and speculation. Behavioural finance and related models also suggest limits to traditional investment theory.

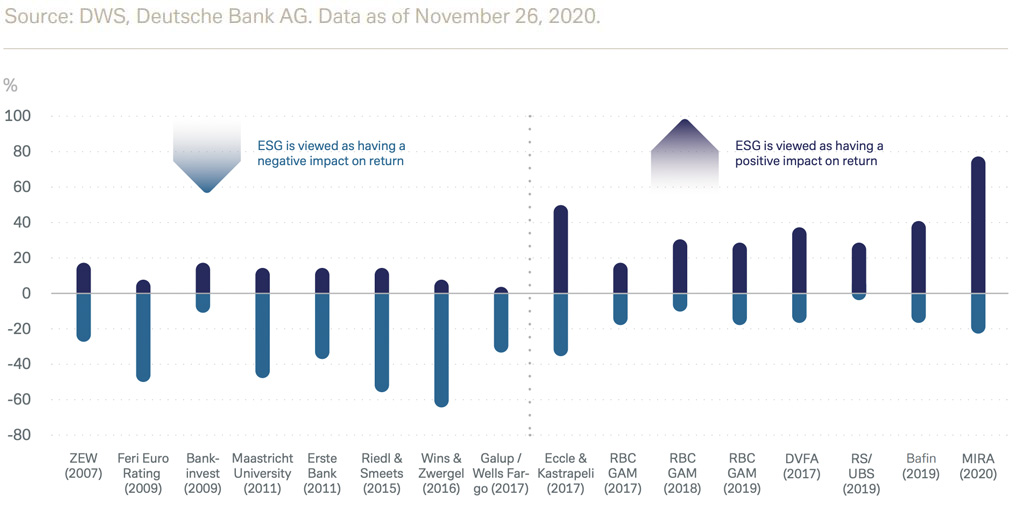

Current considerations of ESG principles in the investment decision-making process have also helped break an old assumption that ESG was associated with lower earnings expectations and higher risk (i.e. volatility). This may be because a previous focus on excluding “sin stocks” in the past has been replaced by more diverse and sophisticated approaches. We now know that ESG strategies can be resilient in times of crisis, from both a short-term and long-term perspective. Nevertheless, valid questions remain about how ESG should be used in investment analysis. A pure ESG assessment on the basis of scores, ratings or exclusion criteria is unlikely to be sufficient on its own as a basis for decision-making. This is because it may not be fully up-to-date, may neglect certain risks, and may not fit easily within existing norms and processes. In addition, the economic dimension needs to be taken into account as ESG might stimulate economic growth by accounting for and promoting the use of natural resources (“natural capital”) as well as implementing social and economic policies.

In the context of taking the usage of natural resources into account, one has to consider the effects of our economic endeavours on our environment and especially the many species inhabiting it. Simply stated: we have to talk about biodiversity. Assessment of biodiversity loss, an increasingly important ESG area, may put a greater focus on current ESG shortcomings and also prompt some solutions. The degradation of biodiversity (biodiversity loss) creates risks (physical, transition, and liability risks) for all companies and industries in different ways and over a period. Hence, any ESG investment assessment needs to look at the entire (product) life cycle and across the whole supply chain of a company. Successful ESG analysis here would help to improve qualitative investment recommendations and decisions. This report focuses on how to do this by also considering nature-related risks. However, oftentimes ESG-related discussions still seem to be about fundamental questions about ESG as an investment concept. Even though perceptions around ESG have changed significantly recently, discussions among investors about broadening the spectrum of ESG discussion are still too rare.

Current ESG perceptions

Investors consider ESG in their decision-making for different reasons. Societal expectations (e.g. tangible impact on risks), regulatory requirements, and personal beliefs are amongst the top reasons for considering ESG. From an investor's point of view, one can say that ESG is perceived as an answer to the fundamental changes in society, regulation, and personal beliefs that we have seen in the last years. However, ESG is still fundamentally an investment concept. This means that “traditional” measurements (e.g. return and risk) are still important.

ESG assessment issues

One of the key enablers for ESG investing is data. There are a number of specialized agencies who aggregate and analyse thousands of data points related to ESG factors, often producing ESG ratings, or scores to compare companies’ ESG performance relative to peers in their sectors. They do this by analysing disclosed data or providing expectations of present and future projections.

Biodiversity adds new opportunities

There is increasing awareness of biodiversity loss as an issue but the subject still needs much more attention. Companies today continue to rely on natural resources while simultaneously impacting ecosystems. For the production of goods and services, ecosystem services are crucial, yet mostly unrecognized. As research suggests, many industries and sectors are threatened by biodiversity related risks. For example, roughly 38% of large publicly traded companies seem to be at least partially affected by habitat loss (sample size: 5,300 corporations). But investors may still be struggling to factor biodiversity into their ESG strategy. For example, in our 2021 survey, only 23% of SMEs and large corporates strongly agreed that they factored biodiversity into their strategy.

The green paradox

The green paradox describes the possible occurrence of undesirable effects from climate or other environmental measures. The fear is that the measures we take to reduce CO2 emissions might cause the exact opposite. One way this could happen is through fossil resource suppliers expanding their extraction as they anticipate lower prices in the future due to announced regulatory measures, thus increasing CO2 emissions. The existence of the green paradox comes with implications, for example: the interests and possible responses of fossil resource suppliers must be taken into account as governments frame environmental measures.

Conclusion

The integration of biodiversity into ESG assessments requires a significant enlargement to the concept of ESG and is therefore driving a serious change towards a sustainable economy. This cannot stop at the “E” (environmental) pillar – biodiversity has great relevance for both the “G” (governance) and “S” (social) pillars.

There are many elements to this integration process. For example, the Sustainability Accounting Standards Board (SASB) materiality map can be used to identify sectors for which biodiversity may be financially material. Using biodiversity as a filter in negative screening could exclude companies exposed to biodiversity-related controversies.

Getting the transition to a sustainable economy right is highly important and adds urgency to biodiversity’s integration into ESG. Better understanding of the data around biodiversity should also help policymakers navigate through a series of tipping points to find the best path through to a nature-positive economy that recognises the value of natural assets.

ESG already enables financial analysis on a much more granular level. But as ongoing developments on biodiversity shows, there is even more we could take into consideration when making investment decisions. As political, societal and, economical efforts push further to fundamentally transform our economy, the way we invest will inherently change. Biodiversity could and should lead the way here.