London Family Office Forum 2025: Managing assets in the new world order

Europe’s rise as a geopolitical force and investment opportunity was a core theme as a record number of family officers joined us in London for this exciting event.

Are we witnessing the beginning of a new era for Europe? It certainly felt that way as around 200 delegates convened in London for our Family Office Conference in June 2025. The venue was 21 Moorfields, Deutsche Bank’s new London headquarters, and our dedicated event space was full of eminent guests and speakers united in their view that this was a pivotal moment for the continent.

This was a chance for family office practitioners, and the families they represent, to meet, network and share ideas about how best to respond to the recent dramatic shifts in global geopolitics and markets. It also allowed Deutsche Bank experts, with the help of leading external thought-leaders, to offer the latest thinking and insights on how to navigate the new, increasingly multi-polar, world order.

Against a backdrop of volatility in geopolitics and the markets, the unique role played by family offices in the global economy – and the unique opportunities and challenges arising from this role – was discussed throughout the day. “The most common way to represent family offices is ‘quiet money, quiet capital’,” said Claudio de Sanctis, Member of the Management Board and Head of the Private Bank, in his opening address. “I prefer an expression [with] a more positive tonality: I believe you are the quiet architects of the future.”

“We’re a relationship bank,” added Salman Mahdi, the Private Bank’s Global Vice Chairman. “We’re 154 years old, and we have multi-generational relationships. So, we’re fully aligned with the values of family offices and their priorities. By putting together events like this, we’re not just bringing family offices to listen to what we have to say but letting them interact and share ideas with each other. We’re building a community.”

Key takeaways from the Deutsche Bank London Family Office conference 2025

- Investors are increasingly looking to Europe as a source of stability, political leadership and long-term investment potential. Europe has outperformed the US substantially in both debt and equity markets since the beginning of 2025, and the investment opportunities here continue to grow. Significant fiscal spending, particularly in Germany, is expected to invigorate the continent’s response to global challenges – provided it remains committed to structural reforms, innovation, decarbonisation, and a stronger single market.

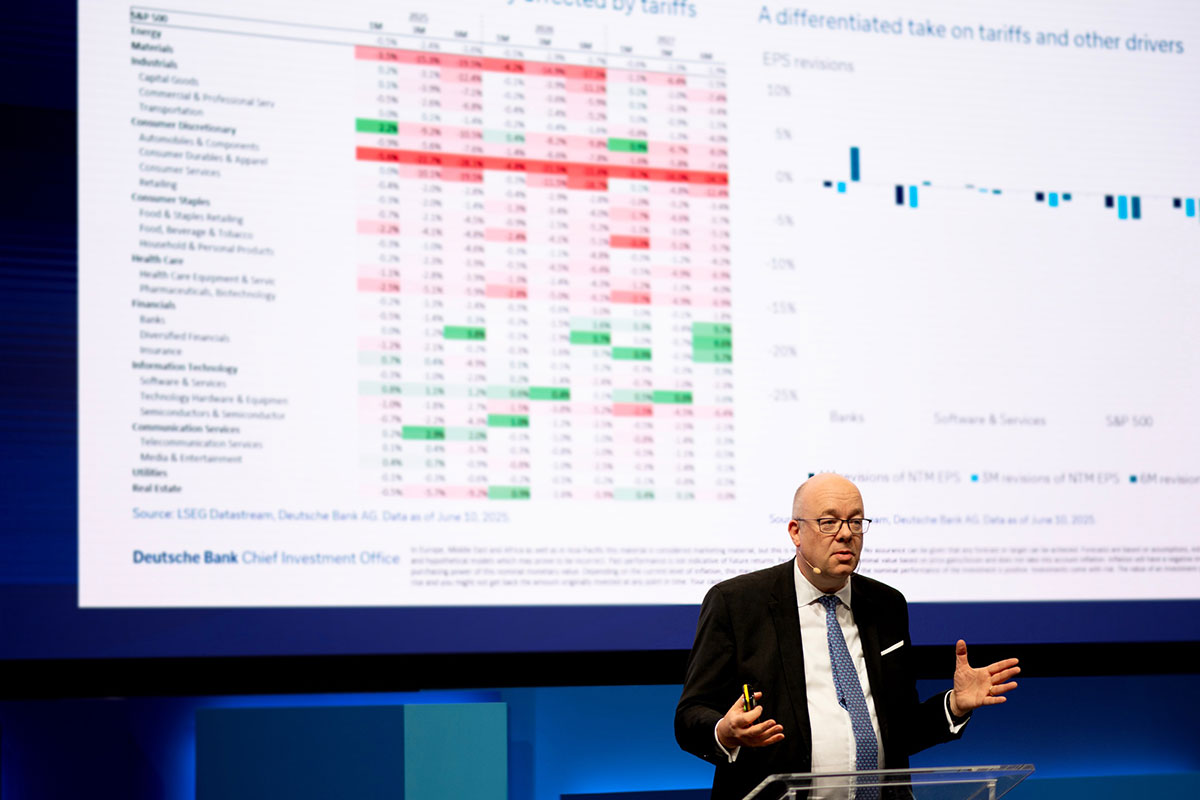

- As the US disrupts international norms, the macroeconomic environment is a source of concern. Christian Nolting, the Private Bank's Global Chief Investment Officer, gave a cautious outlook on recession risks, predicting higher inflation and lower growth. He highlighted the potential for prolonged tariff negotiations to dent confidence and reduce capital expenditure. He also emphasised the need for structural reforms and “energy autonomy” in Europe – especially Germany. Over 60 percent of attendees graded the global economy “neutral” or “weak”.

- Family offices have distinct opportunities in the current environment and can be sophisticated in their approach to risk management. With their long-term investment perspective, strong attachment to values and traditions, and cosmopolitan outlook, family offices may be ideally equipped to navigate the present volatility in geopolitics and the markets. Opportunities in private equity and credit were discussed, as well as a thematic shift in asset allocation based on developments in geopolitics and AI. The importance of risk-free rates and return hurdles was emphasised, along with best practices in managing inflation, liquidity and asset concentration risks.

- Investment opportunities in the digital asset space are growing significantly thanks to advances in technology and regulatory frameworks. Cryptocurrency continues to evolve as an asset class, while related technologies such as blockchain are generating an increasing number of fintech companies and business models. The regulatory landscape is evolving to support innovation in these areas, especially in the UK, though greater global harmonisation is needed.

- Combining long-term vision with short-term flexibility will be critical as volatility continues in geopolitics and markets. Attendees learned from Saudi Arabia’s Minister for Investment about the investment opportunities arising from his country’s Vision 2030 initiative, and from the Indian High Commissioner to the UK about how the new world order requires a new approach to alliance-building. As the world becomes increasingly multi-polar, and as technological advances become ever more disruptive, family offices could benefit from their inherently international outlook and ability to invest with flexibility and agility.

This event was the latest in our series of family office conferences held around the world in recent years. You can find out more about previous events, and about the services we offer to family offices, here.

With special thanks to our guest speakers

- H.E. Eng. Khalid bin Abdulaziz Al-Falih, Minister of Investment, Kingdom of Saudi Arabia (MISA)

- H.E. Mr Vikram K. Doraiswami, Indian High Commissioner to the United Kingdom

- Bronwen Maddox, Director and Chief Executive of Chatham House, The Royal Institute of International Affairs

- Richard Harpin, Founder of HomeServe and Growth Partner & Owner of Business Leader

- Amit Lodha, Co-founder, Director and Chief Investment Officer, Arteqin Capital Limited

- Edoardo Spezzoti, Senior Adviser, former CEO of Ergeny Investments and former Chairman of Global Family Office at UBS

- Francesca Carlesi, Chief Executive Officer of Revolut U.K.

- Alice Kletskaia, Managing Director, Re7 Capital

Click here to activate this content.