Annual Outlook 2024 – Bonds: Real rates matter

Higher yields have put bonds back centre-stage for investors – and investment grade could be the star. Prefer corporates over government bonds due to yield pick-up and sound fundamentals.

Please note: this article is more than one year old. The views of our CIO team may have changed since it was published, and the data on which it was based may have been revised.

Looking back at our outlook last year, our bond forecast for 2023 has been confirmed. With inflation rates falling and interest rates rising, a certain balance was achieved on the bond market over the course of the year.

As a result, after years of extremely low interest rates, the investment universe is now complete again thanks to the renewed attractiveness of bonds as an asset class – and is likely to remain so for the foreseeable future in our opinion.

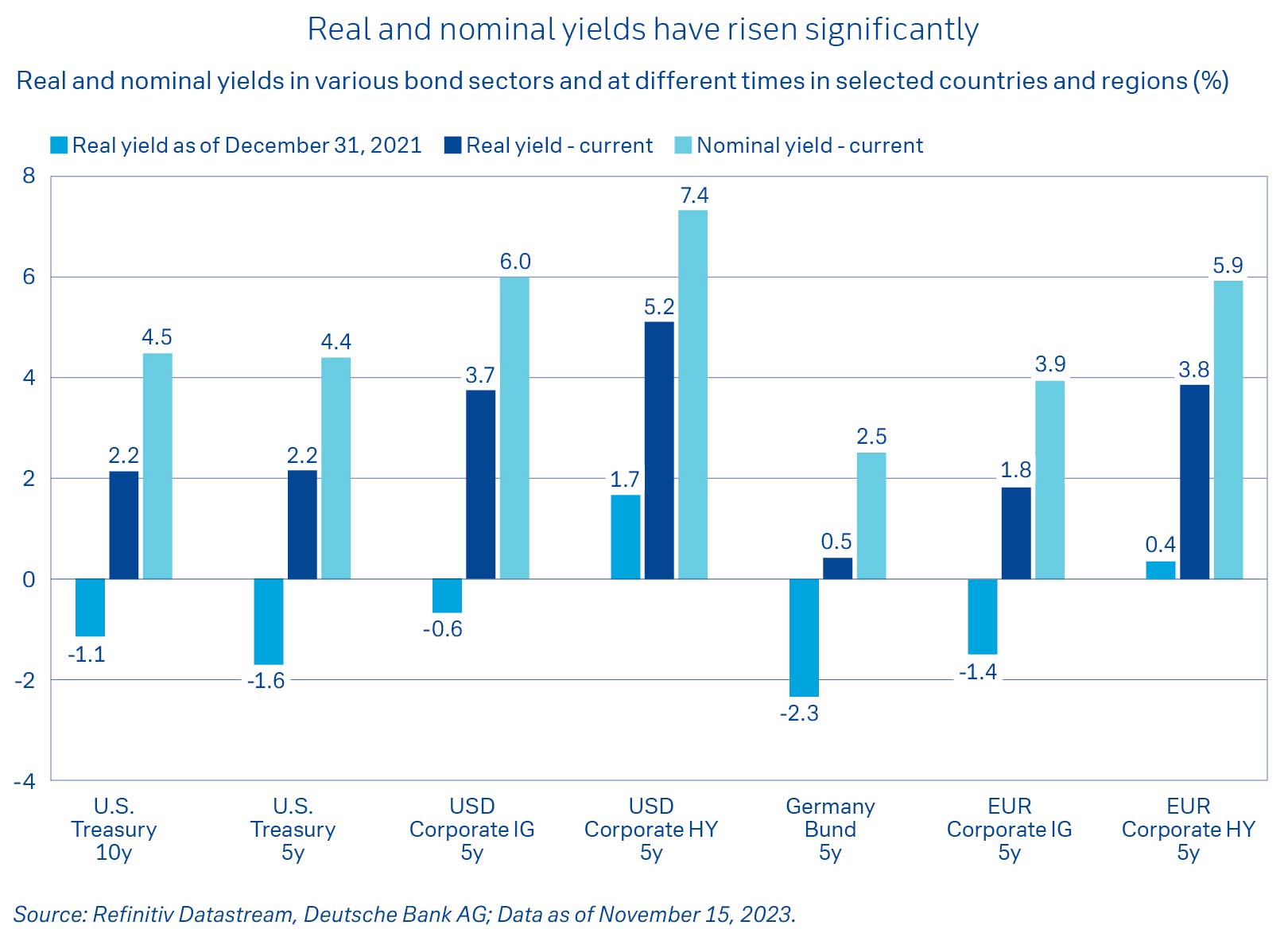

The development of real interest rates, i.e. adjusted for inflation, gives potential fixed income investors grounds for satisfaction. They are now in the positive territory – in some cases significantly so – in all major bond market segments.

This means that investors do not necessarily have to hope for price gains by their securities due to interest rates possibly falling again soon. In our opinion, real interest income alone is currently reason enough to invest, although we expect interest rates to fall slightly in 2024 and, as a result, also expect moderate upside potential for prices.

- Bonds now a fully fledged part of the investment universe after many years of low yields.

- Investment grade has it all: Interesting real yields and low default rates.

- Corporate bonds more appealing than government bonds due to yield pick-up and sound fundamentals .

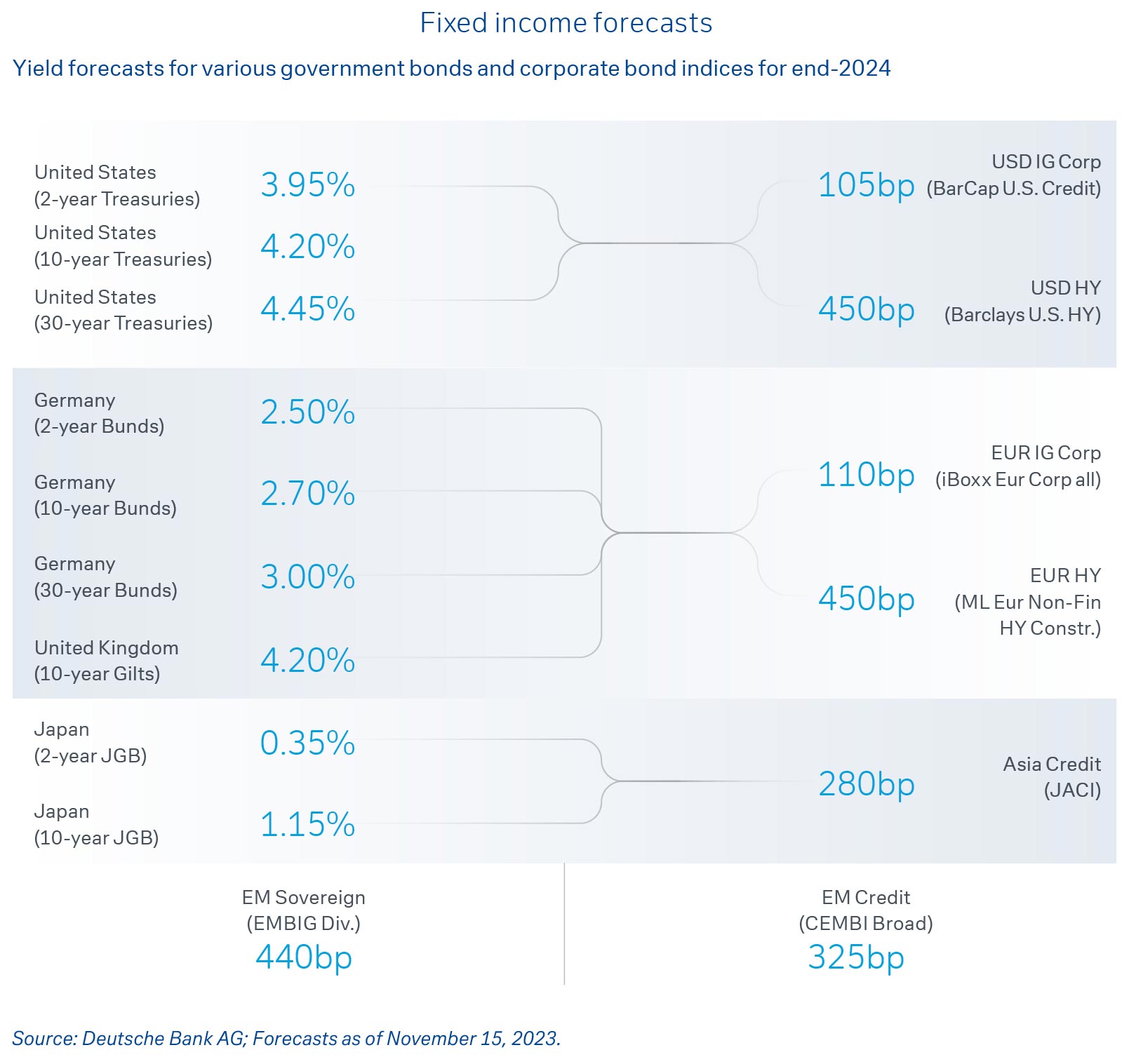

In 2024, we expect mid- to high-single-digit percentage value growth on most of the world’s bond markets. Corporate bonds are likely to be more interesting than government bonds due to their yield pick-up and sound fundamentals. Investment grade (IG) has it all, offering interesting real yields and low default rates.

By contrast, high-yield (HY) bonds usually harbour high risks due to their lower credit rating in an environment of weaker economic data and rising insolvency rates and are likely to be considered by many investors as a niche investment only. As far as maturities are concerned, we consider a mix of short-term (1 to 2 years) and longer-term (up to 10 years) securities to be advisable – with an average of around 4 to 5 years.

From a regional perspective, U.S. bonds offer a clear yield advantage over the European market for example, offering investors from other currency areas a good opportunity to increase the U.S. dollar exposure of their portfolios if necessary.

However, we expect the U.S. dollar to weaken somewhat in the months ahead. Currency losses, for example for investors from the Eurozone, could then only be avoided by hedging accordingly, the costs of which would probably exceed the potential yield advantage. Therefore, EUR IG corporate bonds are our preference for Eurozone investors in 2024. Like their U.S. counterparts, they retain good fundamentals and, thanks to higher yields, could benefit from a possible return of capital flows from alternative forms of investment such as real estate.

When it comes to Eurozone government bonds, Italy could be of interest. The interest rate difference (spread) to German government bonds (Bunds) is currently around 200 basis points for ten-year securities and could widen slightly in the months ahead. The reason for this premium is political uncertainty in Italy coupled with debate about the country’s budget and national debt.

Although we expect some difficult phases, we do not anticipate sustained upheaval in Italy. On the one hand, most Italian government bonds (BBB rating) are held in the country itself; on the other hand, European programmes such as NextGenerationEU or European Central Bank instruments (TPI, PEPP) should provide some reassurance for market participants. By contrast, Bunds offer much greater security with their AAA rating. However, their yield is particularly low due to their virtually unique position as a safe haven in the Eurozone.

The corporate bond markets in the emerging economies are likely to remain largely dependent on China. The economic superpower’s moderate growth and low inflation rates should ensure relative calm in this area. In the HY segment, however, the high proportion of Chinese property developers and banks could prove to be a disruptive factor.

EUR IG corporate bonds are our preference for 2024 because they have good fundamentals and could benefit from a return of capital flows from alternative forms of investment.