Click here to activate this content.

Please note: this article is more than one year old. The views of our CIO team may have changed since it was published, and the data on which it was based may have been revised.

We think that 2024 is likely to be a decent year for investors. Despite all the very evident current global challenges – economic, geopolitical, climatic – investors should keep faith with markets. As this annual outlook explains, prospects in fact appear reasonably good for the main asset classes in 2024. Risk management will however remain crucial.

At present, markets are engaged in a non-stop debate over the likely extent and timing of future monetary policy loosening. Markets will remain sensitive to changing views here: we believe that the first rate cuts by the Fed and the ECB should happen in 2024 but we don’t expect too many. But, as always, it is important to look beyond immediate market volatility and focus instead on what economic and other developments in 2024 could mean for investors – and what might force a reassessment.

The big issue remains economic growth. We think that growth is likely to slow in coming quarters, as tight financial conditions increasingly have an impact on economies. But markets also need to stay convinced that growth will pick up again later in 2024.

We discuss the implications of this for asset classes in the opening sections of this annual outlook. With inflation coming down slowly, and limited rate cuts expected in the U.S. and the Eurozone, there will be opportunities in sovereigns and fixed income will be an important asset class for investors in 2024. Investment grade is likely to benefit in particular from strong yield levels, manageable supply and still-decent fundamentals. (High yield will likely be overshadowed by potential refinancing issues, however.)

Equity markets can interpret the likely restrained fall in rates in various ways. If it is seen as a symptom of economic resilience (rather than intractable inflation fears keeping policy tight), then the implications for equities earnings and the asset class as a whole should be positive – on the assumption, of course, that the expected economic slowdown is not too deep or prolonged. As a result, 12-month equity market returns may be reasonable (high single digits) if not great.

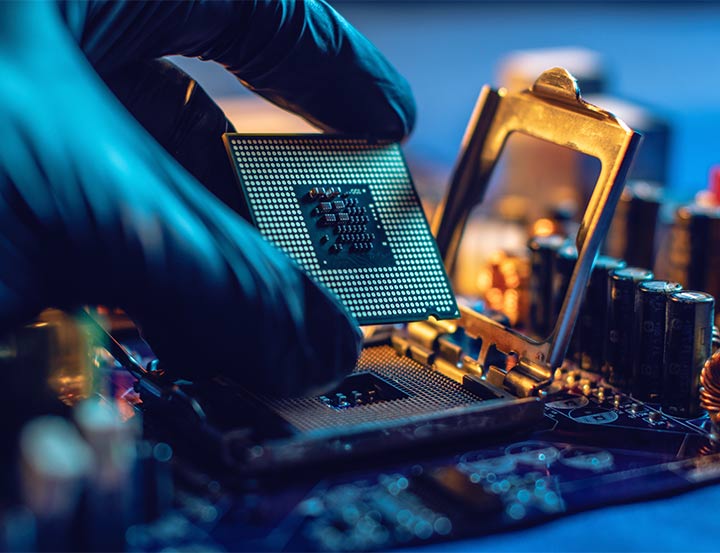

Investors also need to look forward to the risks and opportunities provided by ongoing structural economic change. Technology is both a future driver of such change and a current investment focus as investors try to anticipate longer-term trends. Environmental concerns are also forcing us to rethink the economic status quo and how to manage and finance the transition to a more sustainable economy. The energy transition is already showing how these two issues of technology and the environment are closely intertwined – a relationship that also runs through our other long-term investment themes, discussed later in this outlook.

We hope that this annual outlook therefore provides a useful analysis of the broader issues affecting investors over both short and longer-term time horizons. As noted above, there will be investment opportunities (many growth-dependent) but immediate challenges and structural economic change will make it even more important that portfolios are managed carefully. We look forward to providing you with assistance here, now and in coming years.

Christian Nolting

Global CIO