Economy: Investing creates potential

Expect only moderate growth in industrialised economies in 2024. The long-term challenge remains the delivery of investments to enhance economic competitiveness and fight climate change.

In an increasingly multipolar world that is changing at an unprecedented pace due to technological advances, one of the major challenges facing national economies is how to generate sustainable economic growth. Many trillions of U.S. dollars will be invested worldwide to achieve this in the years ahead.

Sustainable not only means “long-term” but is also used explicitly in the context of an ESG approach that ensures compliance with environmental, social and governance criteria. Today, any proper debate on growth must take into account issues such as climate change, demographics, resource efficiency and equitable distribution.

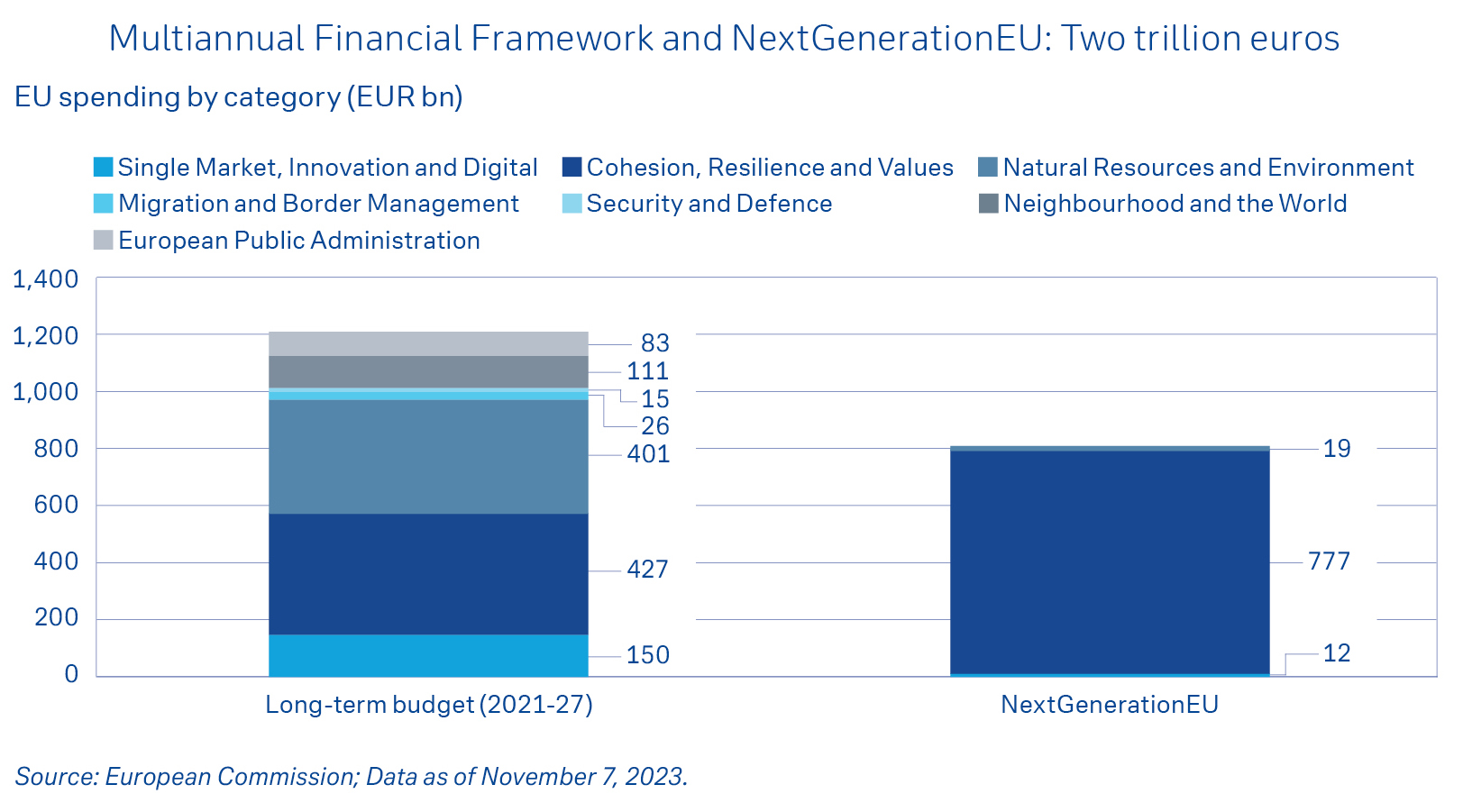

Corresponding investment programmes include the infrastructure package passed in 2021 and the Inflation Reduction Act in the U.S. as well as the NextGenerationEU recovery fund in Europe. However, investments are also being made in many other regions of the world. The NextGenerationEU programme in particular, which together with the long-term European

- Large-scale investments needed to enhance economic competitiveness and fight climate change

- Government spending programmes to incentivise private investment.

- Moderate growth in industrialised economies, Asia remains the global growth engine

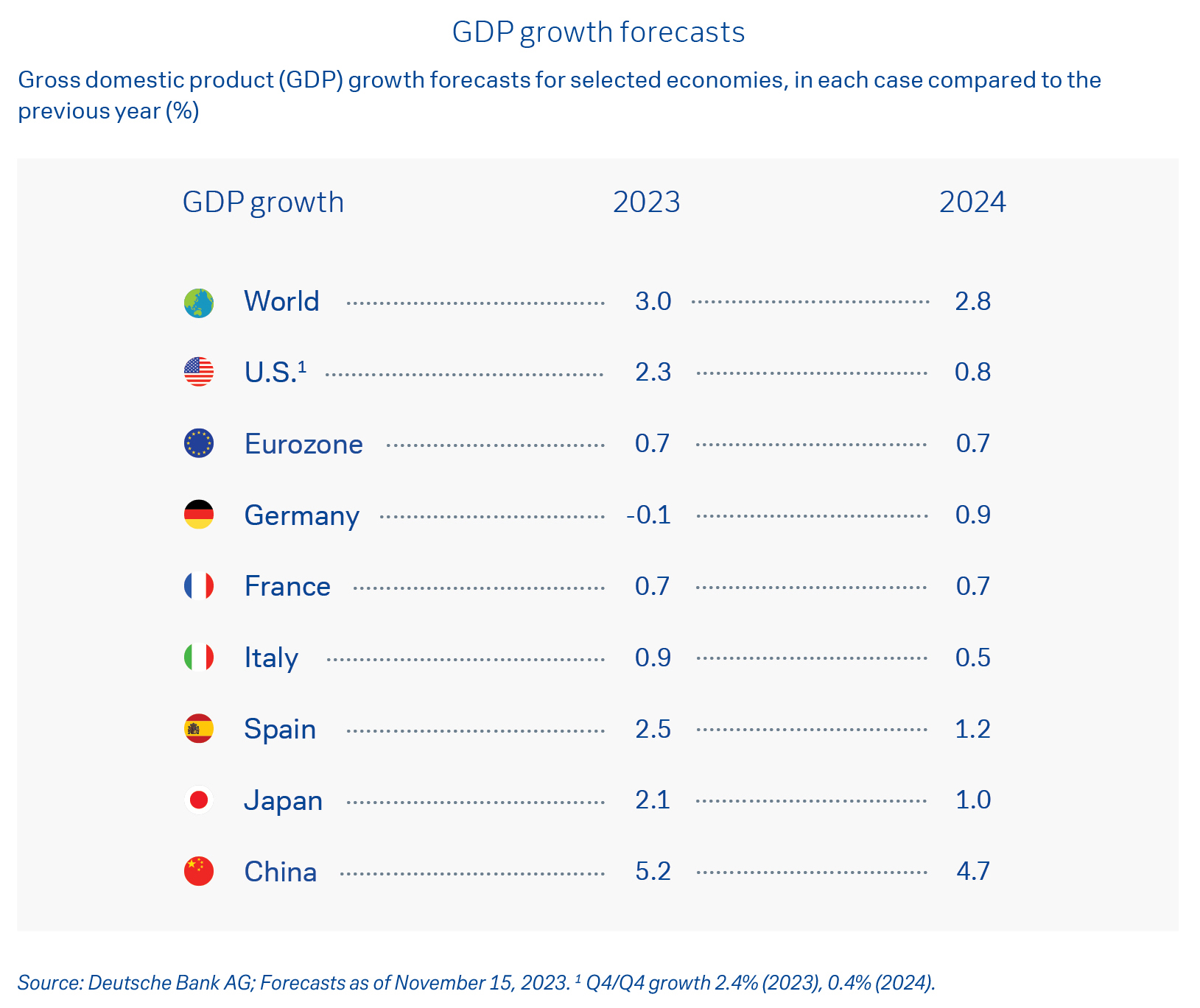

Due in part to the extensive investment programmes, we do not expect a recession in any of the major economic regions in 2024.

Union budget (Multiannual Financial Framework) will deliver investment of more than EUR2tn up to 2027, demonstrates the possibilities of targeted spending. In contrast to the U.S., where it seems that funds are being distributed in a scattergun approach, the allocation of capital in Europe is being linked to the implementation of specific reforms.

The process might take longer, but it establishes a clear framework and channels investment into those areas prioritised by both government and society – the labour market, renewable energy, digitisation, environmental protection, e-mobility and diversity.

In both the U.S. and Europe there is a need to attract private investors as they have a stronger focus on capital efficiency. Europe in particular seems to be on the right track here but the measures already taken are still a long way from achieving their goal.

Due partly to the extensive investment programmes, we do not expect a recession in any of the major economic regions in 2024. For the full year, we anticipate moderate growth of 0.7% in the Eurozone and even 0.9% in Germany. The latter is above our expectations for growth in the U.S. which we put at 0.8%. This is because the coming quarters could be impacted negatively by the delayed effects of the interest rate hikes that began around 18 months ago. However, we expect a tangible recovery in the U.S. in the second half of 2024.

Asia is expected to remain the global growth engine in 2024: growth is likely to be around 6% in India and about 5% in China, for example. Japan could well outperform expectations. At 1.0%, our growth forecast for the Land of the Rising Sun in 2024 is one of the highest among the major industrialised economies.