Annual Outlook 2024 – (Geo)politics: Power play

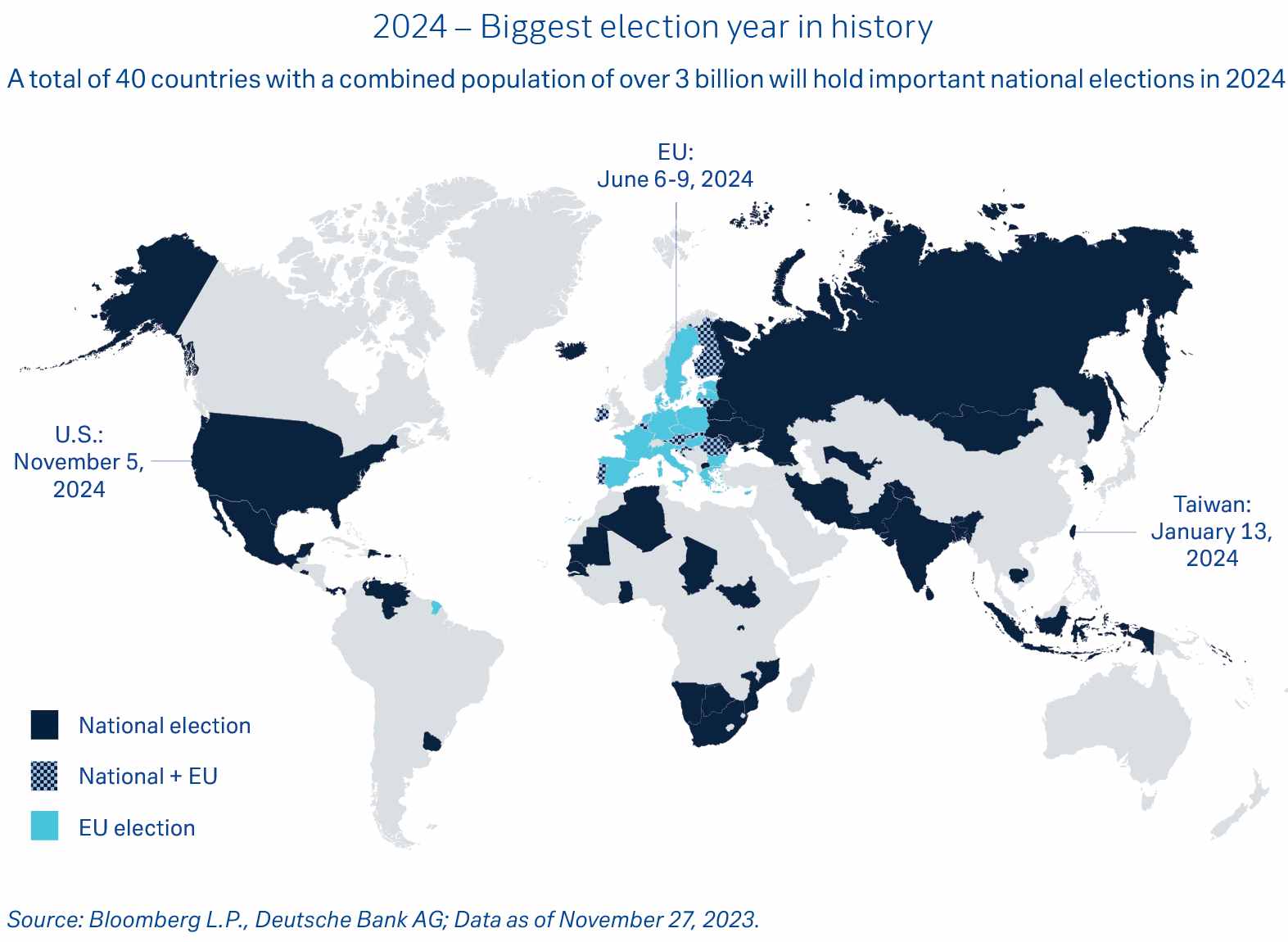

Domestic political developments are increasingly shaping foreign policy agendas – and 2024 will be the biggest election year in history.

The “Great Game” is the name given historically to the rivalry between Great Britain and Russia for supremacy in Central Asia in the 19th century – although it was less a game than a serious geopolitical conflict that lasted for almost a century. A new great game is currently taking place between the United States and China and on a scale that spans the entire world.

This is a contest between two political systems and shows the ambition of assertive emerging economies that are aware of their growing global significance and that are trying to increase their relevance (at a global level, e.g, in international organisations or agreements).

- Battle for hegemony between the U.S. and China is reshaping trading relations.

- Domestic political developments are increasingly shaping foreign policy agendas – focus on elections in 2024.

- Export-oriented economies like Germany and Japan may face major challenges.

Technological advantage has been identified as the key driver for global political and economic leadership, putting the United States in pole position and casting China as the leading challenger (with its own technology strategy). Racing for technology leadership to a certain extent turns global task-sharing into a competition for resources ranging from raw materials, human capital and education to know-how and intellectual property, putting the resilience of supply chains at risk.

While the U.S. is seeking to defend its lead in IT and control over its critical infrastructure by restricting China’s access to high tech, China is trying to leverage and further expand its leading global position in fields such as renewable energy, batteries and e-mobility by tightly regulating its tech sector, restricting foreigners’ market access and controlling domestic players.

These tensions as well as other conflicts and resulting restrictions are prompting aspirations for new international alliances and agreements in trade-oriented regions and countries such as Europe, India, nations on the Arabian Peninsula or Russia and those looking to increase their share of trade.

Regardless of which party has led the U.S. administration since 2017 a shift in trade flows has been observed in this connection – accompanied by trade interventions such as export or import restrictions. These did not diminish with the start of Joe Biden’s presidency.

New trade agreements are being concluded but, unlike in the past, there are fewer multilateral deals and more bilateral ones. Nearshoring and friend-shoring are economic policy responses to improve the resilience of supply chains and ensure access to resources together with reliable partners – especially those from countries in the so-called Global South which are often the source of key commodities. This might lead to formation of new alliances of partners with common interests at different levels.

At the same time, domestic political developments might have more influence on foreign policy decisions and international alliances – not only in democratic societies. The elections scheduled for next year, for example in the U.S., the European Union, India and Taiwan, are therefore being eagerly anticipated across the world.

Trade barriers like sanctions or restrictions and changes to political or economic agreements could pose challenges to those economies based on foreign trade. If trade takes place increasingly on a bilateral basis, the U.S. and China – thanks to their economic structures – can more or less confine themselves to satisfying their own domestic demand and trading with their closest partners. By contrast, export-oriented economies like Germany and Japan are more dependent on the free flow of goods worldwide and are therefore impacted more severely by sanctions and supply chain problems.