In this CIO Viewpoint Commodities – Gold with potential, Oil stable and Lithium looking for the bottom – we discuss what influence the central banks have on the future price development of gold and in which direction the production decisions of OPEC+ could possibly move the oil price. This issue is supplemented by a short digression on lithium, which is expected to play an important role in the global energy transition in the long term.

Key takeaways:

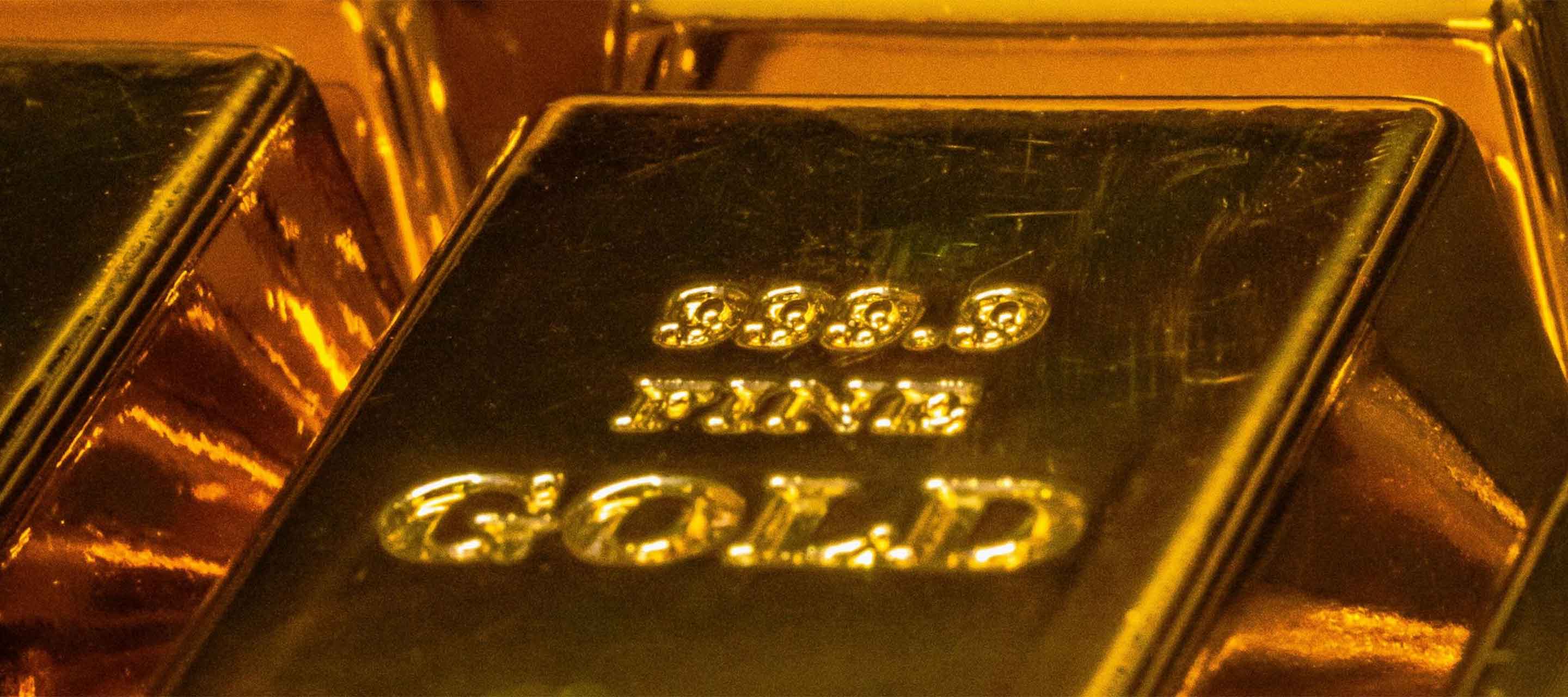

- Gold prices recently received a tailwind from lower-than-expected inflation data from the U.S. and the repricing of Fed rate cuts on the swap markets.

- Oil price movements will largely be driven by developments in global growth and the production volumes of the OPEC+ countries.

- Lithium – the "green" industrial metal – continues to offer a structurally positive outlook, but the market is currently still in an imbalance.