Venture Capital trends

Our CIO Special on venture capital investing examines: • Growth in this area of investment • The wide range of risks involved • Diversification and its potential role in portfolios

Please note: this article is more than one year old. The views of our CIO team may have changed since it was published, and the data on which it was based may have been revised.

Growth and the COVID-19 pandemic

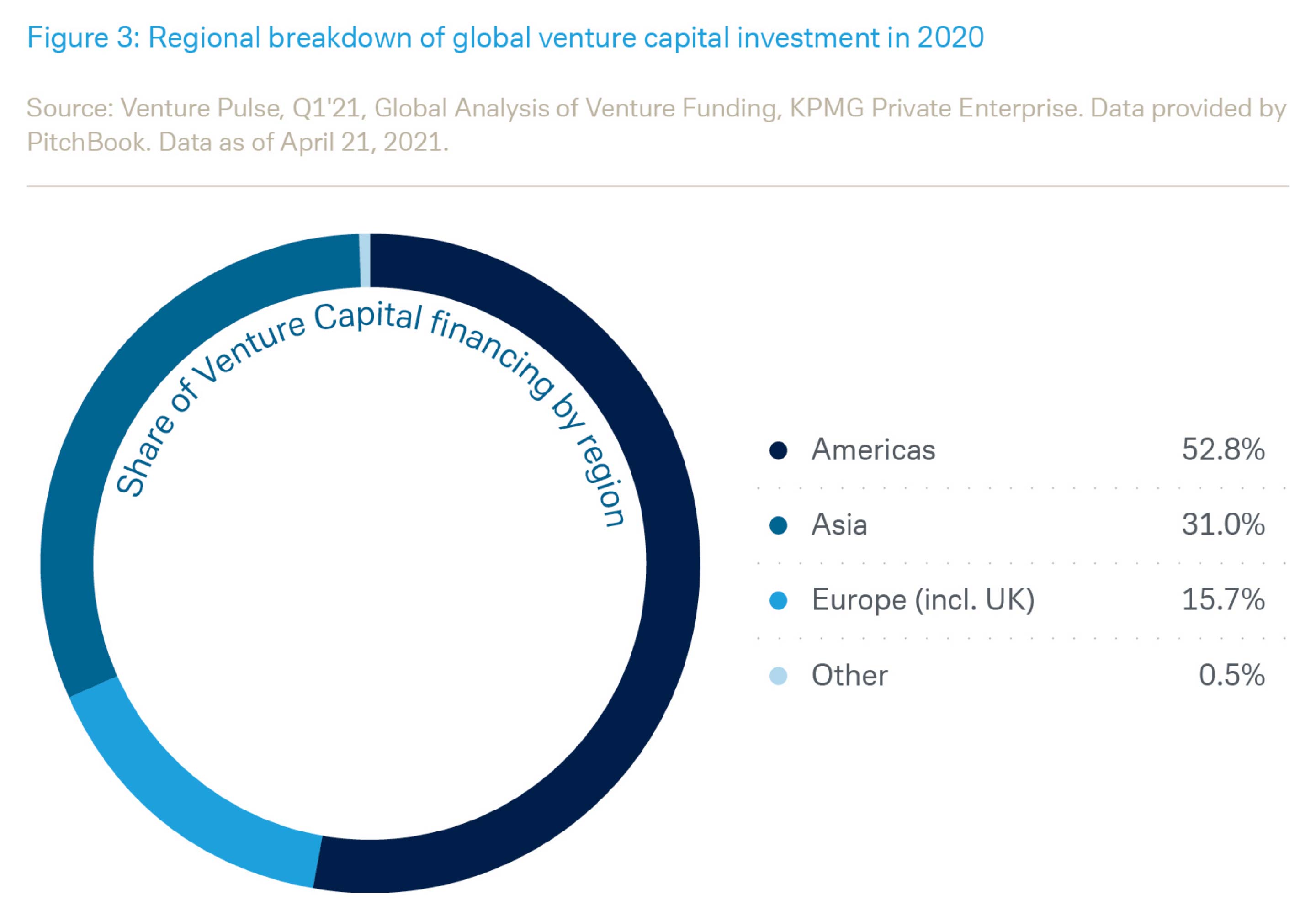

Global Venture Capital investment increased at a 13.5% compound annual growth rate (CAGR) between 2015 and 2020, to reach a total of USD330.2bn in that year. The Americas has still the biggest market share, accounting for 52.8% of total deal value in 2020. Asia and Europe account for 31.0% or 15.7% of the global market, respectively (see Figure 3).

In 2020, coronavirus was highly disruptive to many sectors but also boosted technological transformation and innovation as the corporate world strived to capitalize on booming digitization trends and to rethink business models. This environment of rapid change led to a funding surge in numerous segments during the second half of 2020 as investors tried to engage with companies experiencing the most extensive acceleration in demand.

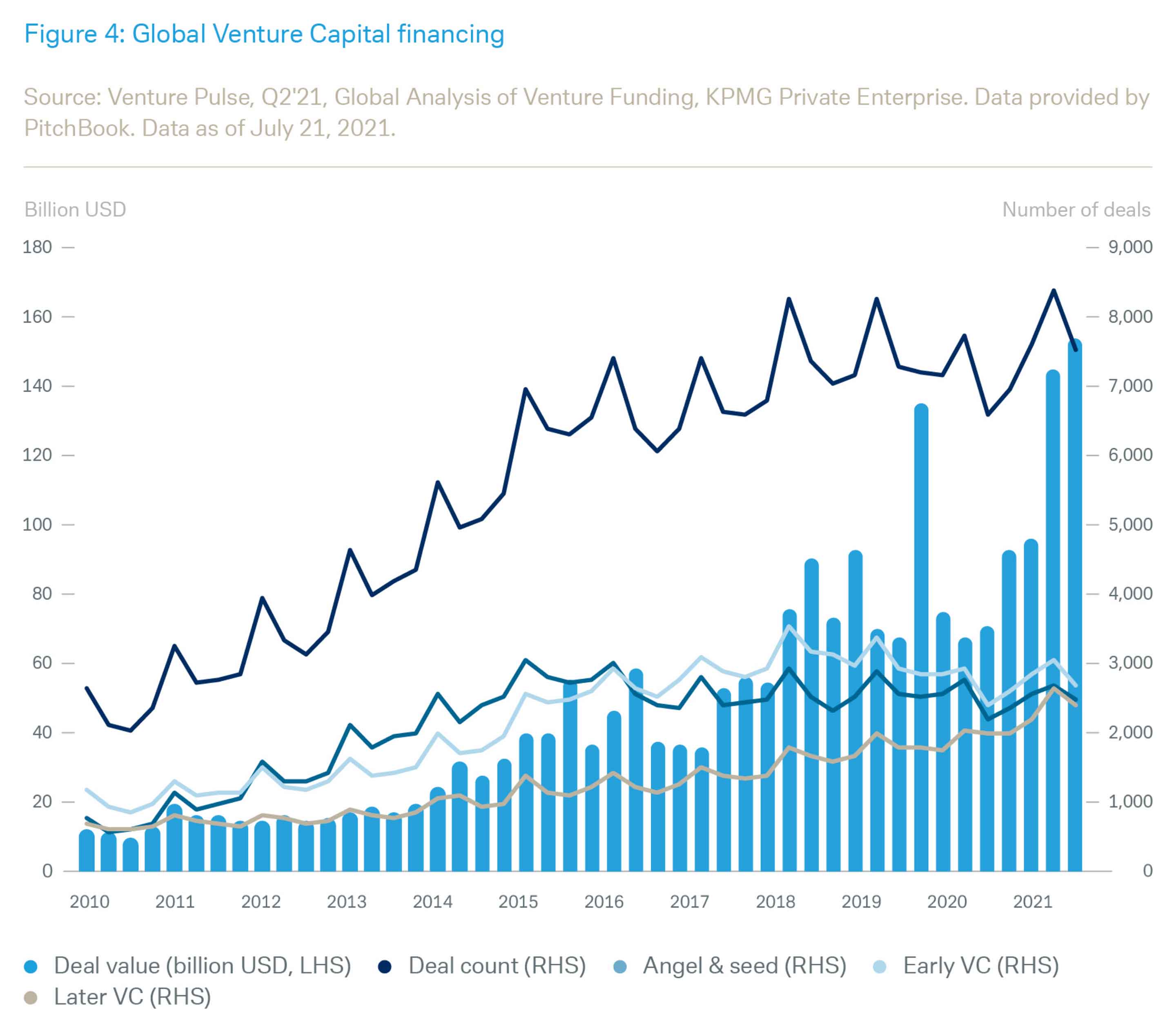

Global venture capital investment then reached unprecedented levels in 2021 with Q2 2021 with capital investment at USD157.1bn (see Figure 4). Europe (USD34bn), the United States (USD75bn) as well as the overall Americas region (USD84bn) have all hit new highs for VC financing volumes, although Asia (USD38bn) remained well below its Q3 2019 peak. It is worth mentioning that Europe has now seen four consecutive quarters of record VC investment and the sixth straight quarter of increases in Venture Capital financings. This impressive growth was mainly driven by a rising number of mature companies as well as existing “unicorns” (companies with a valuation over USD1bn) that demand substantial amounts, across various sectors/ industries. While UK deal volumes were slightly down from the record levels reached in Q1, Ireland and Germany have seen their strongest quarters in terms of VC investment ever.

It is striking that, over the last four quarters, global VC investment has been growing on YoY basis, despite lower deal counts. This may reflect a growing preference for proven business models and later-stage deals across most regions of the world, because during periods of high uncertainty, later-stage companies may be regarded as safer bets. The risk here is that continued falls in very early stage VC financing could have a longer-term adverse impact for the overall deal pipeline. Rivalry among investors to get a piece of the cake has also certainly fuelled concerns about high valuations in some sectors – but high post-IPO multiples for companies that eventually go to market are helping to back current price levels.

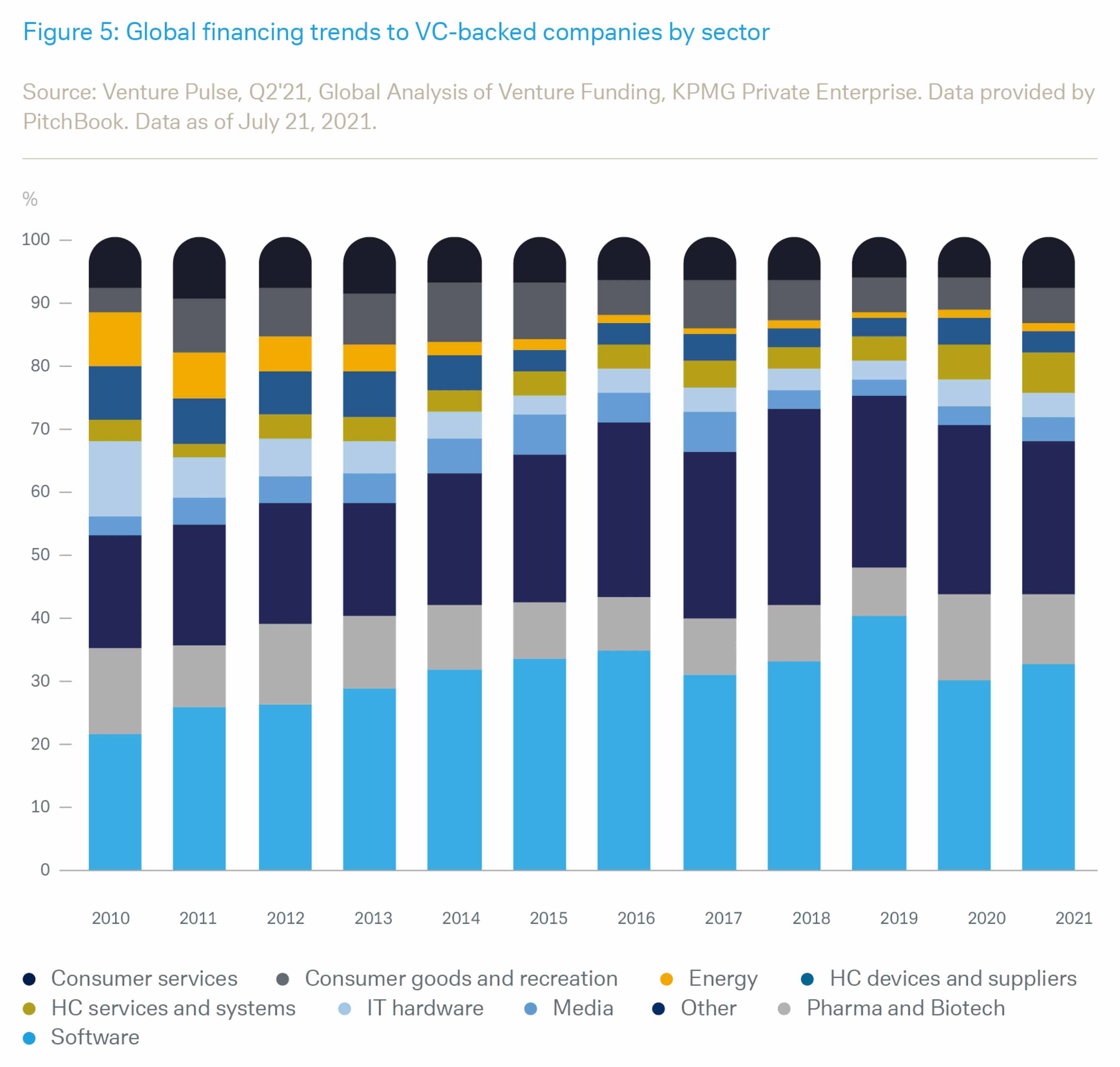

In H1 2021, most funds invested went into sectors boosted by the pandemic. Software and diverse consumer-centric digital solutions (e.g. gaming, fintech, edtech, logistics and food delivery as well as healthcare and biotech) were sought after. But this is not just a short-term response: Figure 5 looks at the sectoral breakdown of global Venture Capital financing since 2013 and shows that software, pharma & biotech and health services & systems have increased their share of total investment.

"Most funds in 2021 have gone into sectors boosted by the pandemic. But this is not just a short-term response."

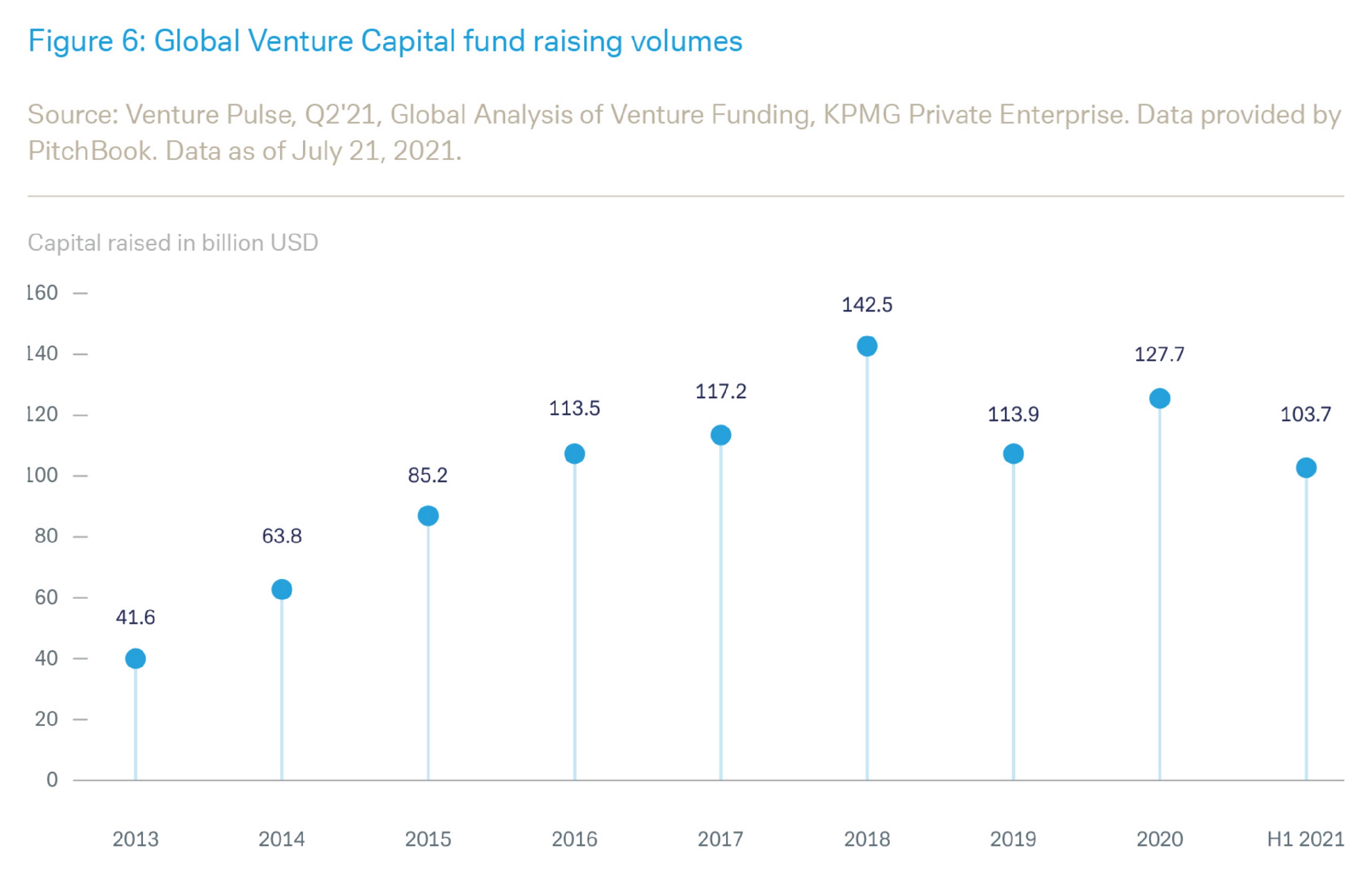

Investors have also continued to commit large amounts of funds to Venture Capital funds. USD 127.7bn was raised in 2020, with capital commitments then reaching USD103.7bn in H1 2021 (see Figure 6). If the pace of capital commitments continues at the current rate 2021 will probably see the first-ever USD200bn+ globally allocated to Venture Capital funds. The concentration of funds is also clearly rising (i.e. more capital allocated across fewer investment vehicles). In 2021 there has been a stronger focus on “USD1bn+ funds” with investors looking for fund managers with a proven track record of “best in class” returns. But there are still significant first-time fundraisings and an increasing number of vehicles are aiming at stakes in niche areas (often underserved segments) which might benefit radical innovation.

"The concentration of funds is rising: more capital is being allocated – but across fewer investment vehicles."

Medium-term outlook

Over the medium term, the overall environment is likely to remain supportive for further growth of the Venture Capital market. Plenty of “dry powder” (the industry term for committed but as yet unallocated funds) exists in the market and competition for the top deals should support valuations. A continuing low interest rate environment in many parts of the world is also likely to maintain investor interest in Venture Capital.

Digitization trends as well as shifting consumption and investment habits may also help developing the Venture Capital market even further. Mutual funds and the banking industry are also making it easier for their clients to access the Venture Capital universe.

Looking beyond the COVID-19 pandemic, Venture Capital investments into many areas of the healthcare universe are likely to stay buoyant given the need to revamp many facets of the healthcare system and the opportunities for new technologies to be utilized or leveraged in this context (Healthcare is one of our long-term key investment themes). AI and robotics also seem likely to become core Venture Capital investment themes.

The shape of the Venture Capital industry may also change. Corporate Venture Capital investment also continues to gain steam with established companies on the lookout for innovative start-ups able to help them expanding their digital portfolio and improve the efficiency of their operations.

We may also see changes in the final stage of Venture Capital investing – when investors realize their gains by bringing companies to public markets.

SPACs (Special Purpose Acquisition Companies) have been increasingly evident in recent quarters, and represent an alternative to the traditional initial public offering (IPO) way for a firm of exiting private ownership and “going public”. (Investors commit money to the SPAC on a “blank cheque” basis and then the SPAC itself goes public, rather than the firm it eventually purchases). There are a number of legitimate concerns with the SPAC approach, for example around whether it will encourage firms to go public before they have achieved the necessary maturity. The performance of announced SPAC mergers over the next few quarters may determine whether they turn out to be a longer-term trend or not.

IMARC (a leading market research company) forecasts global Venture Capital investment to grow at a CAGR of around 16% over 2021-2026: if achieved, this would represent even faster growth than over the last five years.

For a brief summary of the report and to download the full PDF, please click here.

In Europe, Middle East and Africa as well as in Asia Pacific this material is considered marketing material, but this is not the case in the U.S. No assurance can be given that any forecast or target can be achieved. Forecasts are based on assumptions, estimates, opinions and hypothetical models which may prove to be incorrect. Past performance is not indicative of future returns. Investments come with risk. The value of an investment can fall as well as rise and you might not get back the amount originally invested at any point in time. Your capital may be at risk. This document was produced in August 2021. Readers should refer to disclosures and risk warnings at the end of this document. 050787 010722