Impact #1: Our daily lives – no return to the status quo ante

• The growing role of the state • Inequality in sharper focus • Infrastructure rethought

The impact of coronavirus on individuals has varied enormously by geography and income group.

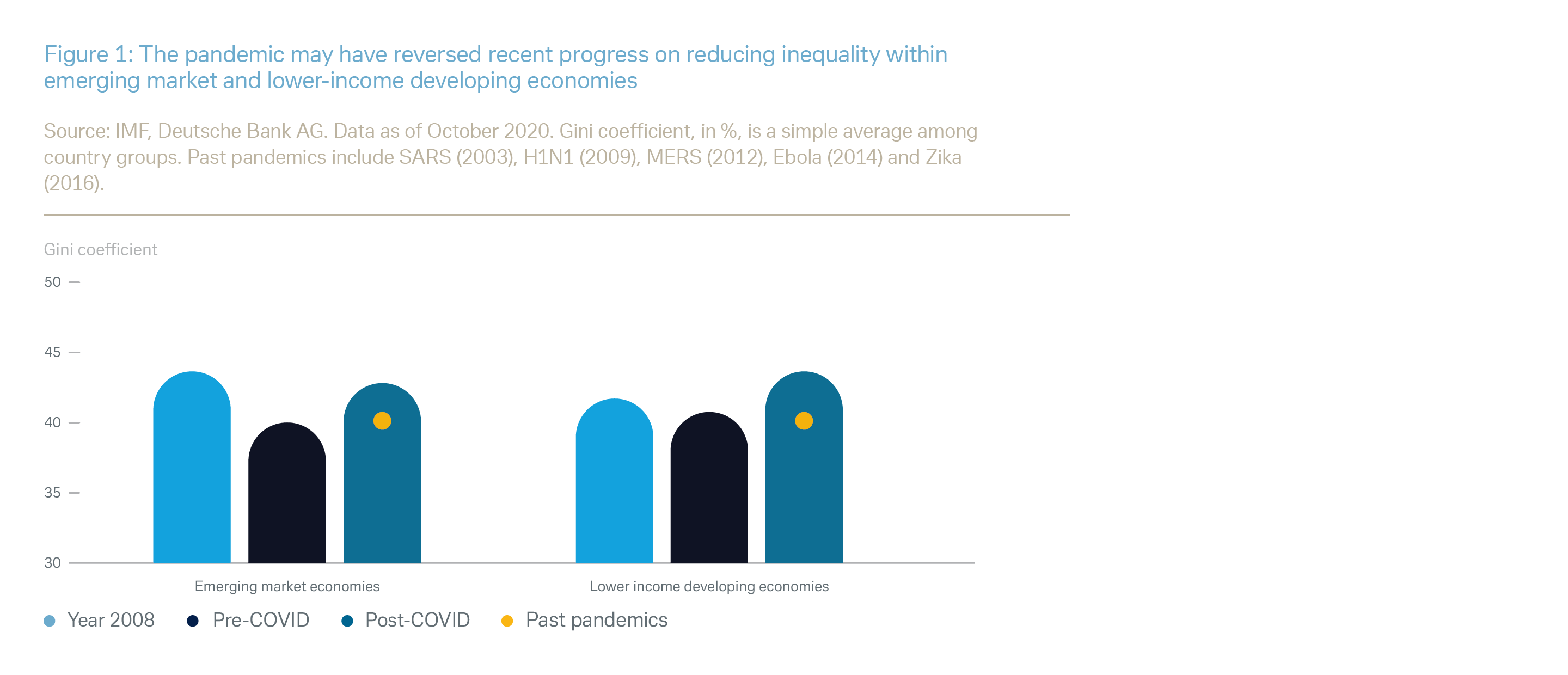

Many professional, administrative and managerial workers around the world have used digital technology to work remotely – at a time when manual and care workers (or those without digital access) have had to go out to work, balancing worries about disease infection and job insecurity. In many emerging markets, lock-downs may have been shorter, but problems of inequality have been highlighted here too. Figure 1 looks at trends in the Gini coefficient, a measure of inequality, for both emerging markets overall and lower-income developing economies.

Different population groups will also have different experiences over the next few years. But several key themes will run through most people’s experience, long after the worst of the coronavirus pandemic is behind us. We focus below on three results of the crisis.

Result #1: The growing role of the state

An increasing presence of the state in people’s lives will be due to several factors.

Economic crisis has led to a greater role for the state in unemployment or wage support and this looks likely to be extended in many cases until at least mid-2021. This is unlikely, however, to be able to fully offset structural changes in employment or relative wage levels. Questions around the merits of individual responsibility vs. social security nets will persist and be an important subject for political debate.

The pandemic has underlined the importance of the state in healthcare provision (even if provision is usually private). Concerns about disease control and populations’ health are not going to go away: healthcare is one of our key themes, discussed in Impact #5.

Another long-term issue, certain to go well beyond 2021, is the role of technology in delivering state support, e.g. through payments to individuals via central bank digital currencies, which we discuss in Impact #3.

Result #2: Inequality in sharper focus

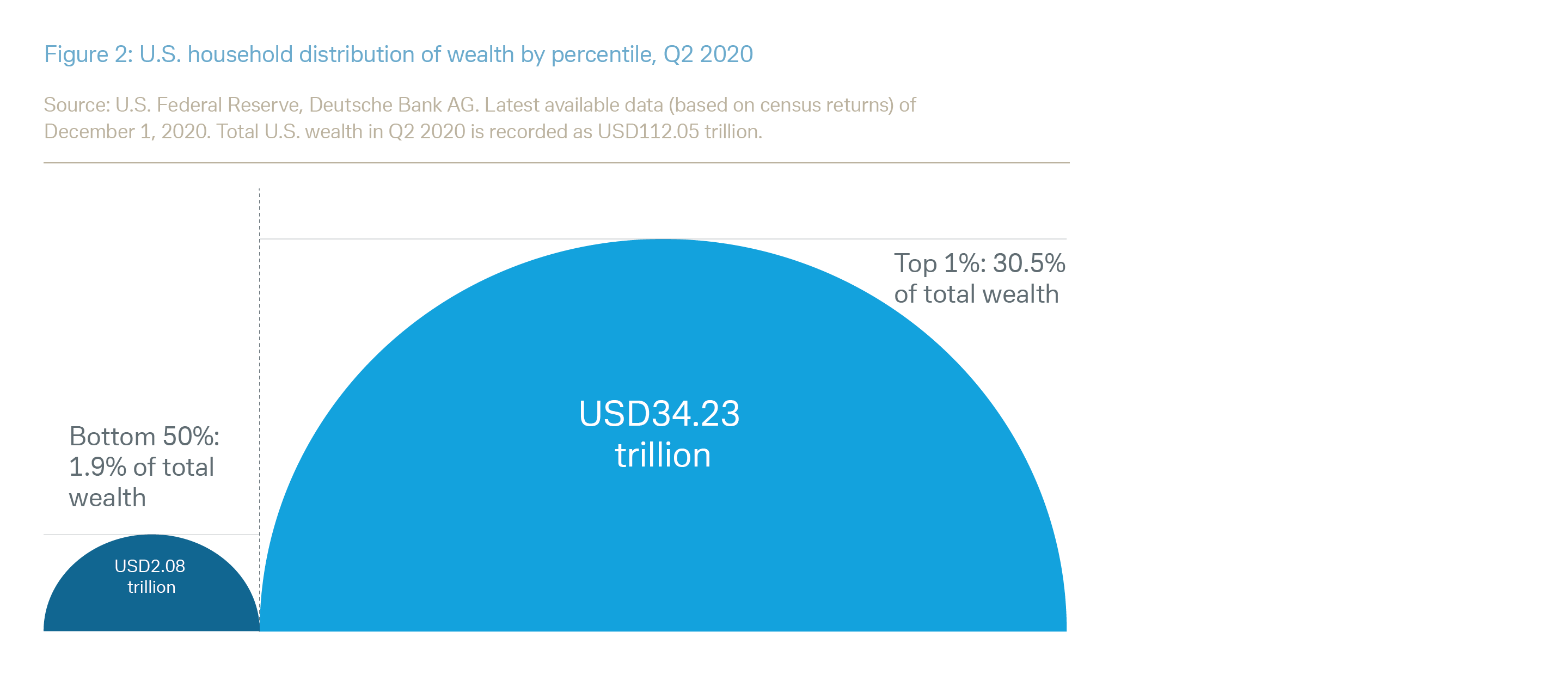

One underlying issue will be particularly debated in the aftermath of the coronavirus crisis. The crisis has increased the role of the state but has also revealed its shortcomings, in the form of long-term increases in inequality – with more abstract numbers around wealth and income inequality (Figure 2 shows U.S. household wealth inequality) translating during the pandemic into more brutal social divergence in public healthcare access, infection rates and disease outcomes. So we may see renewed discussion around social issues such as universal basic income, even if extended budgetary pressures would normally tend to discourage government largesse. It seems likely that we will see higher taxation on wealthier individuals, partly to help finance the substantial increase in government budget deficits as a result of the pandemic, but also to address these increasing concerns about inequality. Again, as with many other coronavirus- related issues, this was a pre-existing trend that the pandemic has brought into sharper focus. Concerns about inequality are likely to further intensify if the pandemic results in a sustained increase in unemployment for certain income groups, or if governments eventually have to cut back on social support networks due to budgetary constraints.

Result #3: Infrastructure rethought

Individual behaviours have also been changed by the crisis. The move towards on-line shopping has been much discussed: “farewell to the high street” is a long-term trend simply accelerated by the crisis. But changing lifestyles will have much broader implications.

But a discussion also needs to be had about what sort of infrastructure (another of our key investment themes) is needed to meet these changed demands. We discuss future real estate trends immediately below, but other aspects need considering too – we may for example see a change in how people move around urban areas, with smart mobility (a key investment theme) under the spotlight.

Real estate trends already demonstrate the complexity of coronavirus impacts. The problems of retail sector real estate are well documented. Pre-existing pressures from e-commerce have been amplified by the coronavirus and it is difficult to see how trends here can be fully reversed. For office real estate, many transactions will likely remain on pause for a while: firms may change the way that they use office space and the way that they purchase it. In addition to lower total office space demand in some markets (e.g. those with high financial services exposure), we could see shorter lease terms and other financial innovations. Industrial real estate has seen some growth areas (e-commerce fulfilment centres and healthcare). For residential real estate the outlook is mixed – affordability will depend on economic recovery and employment levels, but long-term drivers remain (e.g. secular changes in household ownership and household growth).

Consequences

- Increased presence of the state.

- Inequality in sharper focus.

- Behavioural, lifestyle and business trends impact infrastructure and consumption (millennials and platform economy).

Our full CIO Insights report “Annual Outlook 2021: Tectonic shifts" includes our new macroeconomic and financial market forecasts for 2021. Please refer to the Important Notes at the end of the report for disclosures and risk warnings.

To download a printer-friendly PDF of the full report, please click here.

To view a mobile-optimised version of the full report, please click here.